Top Case Study Interview Questions & Expert Tips

Prepare for your interview with our guide on key case study interview questions. Get expert advice, frameworks, and tips to succeed.

Case study interviews are the gateway to top-tier consulting, finance, and strategy roles, but they often feel like an unsolvable puzzle. Success isn't about finding a single "right" answer. It's about demonstrating a structured, analytical, and commercially savvy approach to complex business problems in real time. The interviewer wants to see how you think, not just what you know. This is your chance to prove you can deconstruct ambiguity, apply logical frameworks, and communicate recommendations with clarity and confidence.

This article breaks down the six most common and challenging case study interview questions you will almost certainly encounter. We move beyond generic advice to provide a strategic blueprint for each type, covering the essential frameworks, critical questions to ask, and common pitfalls to avoid. You will learn to tackle everything from market entry and profitability declines to complex M&A and digital transformation scenarios.

By mastering the specific tactics and actionable takeaways for each case, you will transform these intimidating challenges into your greatest opportunity to stand out. Let's dive in and equip you with the structured thinking needed to turn your next case interview into a job offer.

1. Market Entry Strategy Case

A cornerstone of management consulting interviews, the Market Entry Strategy case is one of the most fundamental case study interview questions you will encounter. This scenario asks you to evaluate whether a company should enter a new market, which could be a new geographic region, product category, or customer segment. Your task is to build a structured, data-driven recommendation on whether to enter and, if so, how.

This case type is popular with firms like McKinsey, BCG, and Bain because it tests a wide range of core consulting skills: structured thinking, quantitative analysis, strategic reasoning, and business acumen. You must dissect a complex business problem into manageable parts, analyze each piece, and synthesize your findings into a coherent, persuasive argument.

Core Framework and Analysis

The analysis typically begins with a high-level assessment of the market's attractiveness and the company’s ability to win within it. A robust approach involves breaking down the problem into three key areas: the market itself, the competitive environment, and the company's internal capabilities and financials.

- Market Analysis: How big is the market? What is its growth rate? What are the key customer segments and their unmet needs?

- Competitive Landscape: Who are the major players? What is their market share? What are the potential barriers to entry (e.g., regulations, high capital costs, brand loyalty)?

- Company Capabilities & Financials: Does the company have the resources, brand recognition, and operational capacity to succeed? What are the projected revenues, costs, and profitability of entering?

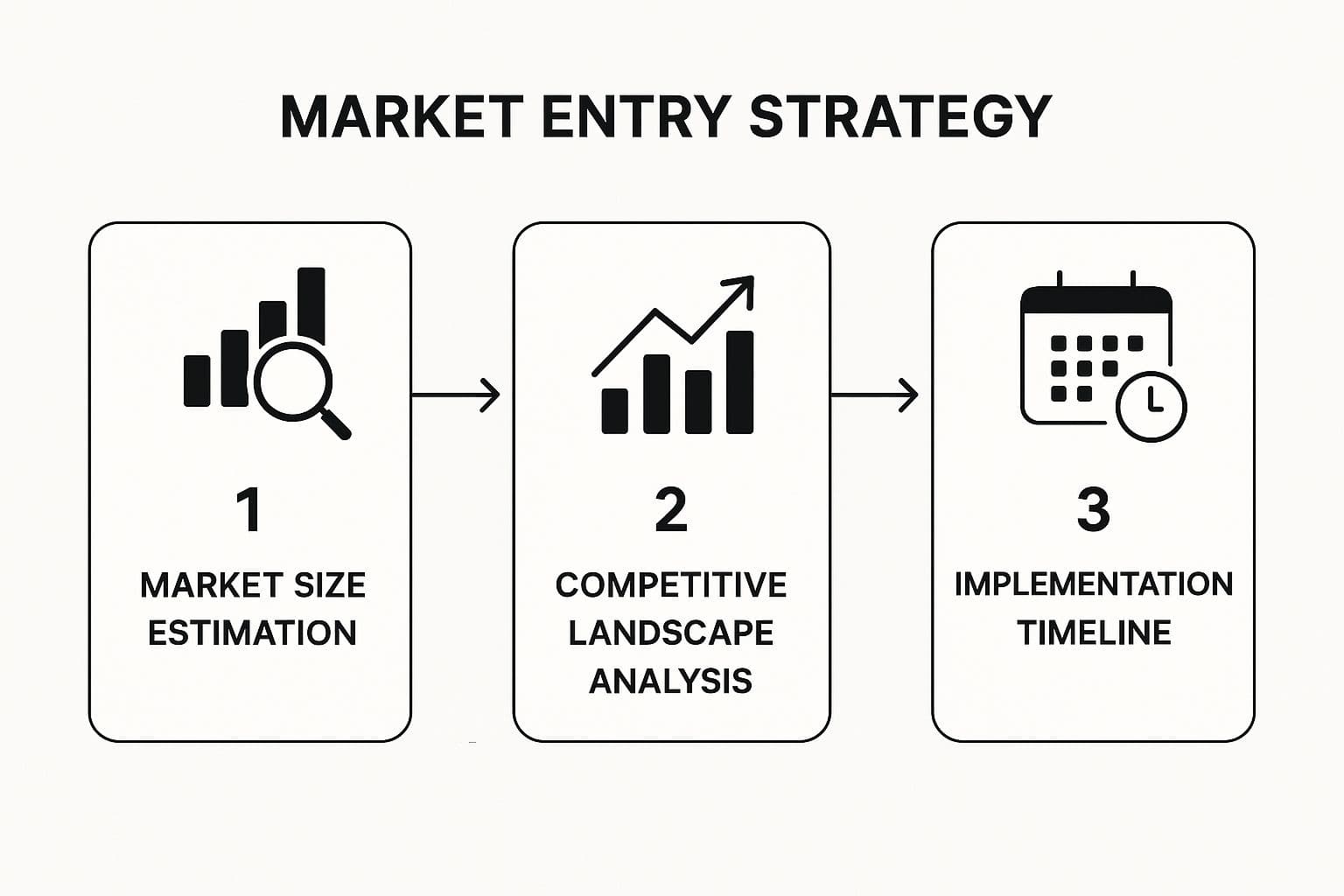

A systematic approach is crucial. The following infographic illustrates the high-level process flow for tackling these questions.

This process ensures your analysis moves logically from understanding the opportunity to assessing the challenges and finally to planning the execution.

Actionable Tips for Success

When presented with a market entry case, avoid jumping straight to a "yes" or "no." Instead, state your structured approach upfront.

Strategic Insight: Your primary goal isn't just to find the "right" answer but to demonstrate a logical, comprehensive thought process. The interviewer is evaluating how you think.

Start by sizing the market using both top-down (e.g., total population -> target demographic) and bottom-up (e.g., average price x number of potential customers) methods to triangulate a reasonable estimate. Always quantify your assumptions. Finally, present multiple strategic options (e.g., build organically, acquire a local player, or form a joint venture) with clear pros and cons before making a final recommendation. For a deeper dive into structured frameworks, you can learn more about how to apply these concepts in other consulting case study examples on Soreno.ai.

2. Profitability Decline Case

Another essential component in the lineup of case study interview questions, the Profitability Decline Case is a diagnostic exercise at its core. You are presented with a scenario where a company's profits are falling and tasked with identifying the root cause(s) and proposing concrete solutions to reverse the trend. Your role is to act as a business detective, systematically investigating potential issues to pinpoint the source of the problem.

This case is a favorite among top consulting firms as it directly mirrors a common client engagement: figuring out why financial performance is suffering. It rigorously tests your ability to structure a problem, generate logical hypotheses, perform quantitative analysis, and move from diagnosis to actionable recommendations. The ability to break down profitability into its core components is a fundamental consulting skill.

Core Framework and Analysis

The foundational tool for a profitability case is the profit formula: Profit = Revenue – Costs. This simple equation forms the backbone of your "profit tree," a framework used to methodically dissect the problem. The analysis involves drilling down into each branch of this tree to isolate the problematic area.

- Revenue Side: Is the decline due to falling prices or a drop in sales volume? If volume is down, is it an industry-wide trend or a company-specific issue like losing market share?

- Cost Side: Have costs increased? You must segment costs into fixed costs (e.g., rent, salaries) and variable costs (e.g., raw materials, direct labor) to understand where the pressure is coming from.

- External vs. Internal Factors: Is the problem caused by internal inefficiencies (e.g., rising production costs, ineffective marketing) or external market forces (e.g., new competitors, changing customer preferences, economic downturn)?

A logical, issue-tree approach is non-negotiable. You must start broad by examining both revenue and costs, then systematically eliminate possibilities as you gather more data from the interviewer, narrowing your focus until you uncover the root cause.

Actionable Tips for Success

When you hear the word "profit," immediately sketch out the Profit = Revenue - Costs framework. Ask clarifying questions upfront to understand the magnitude, timeframe, and context of the decline.

Strategic Insight: The interviewer is not just looking for the answer; they are assessing your process. Clearly articulate your framework and walk them through your hypothesis-driven investigation step-by-step.

Begin by analyzing one side of the profit tree first, for example, investigating all potential revenue drivers before moving to costs. Always benchmark the company's performance against its competitors and historical trends to determine if the issue is unique to the business or part of a larger market shift. Your final recommendation should not just identify the problem but also provide specific, data-backed solutions with an estimate of their potential impact on the bottom line.

3. Pricing Strategy Case

A classic test of commercial acumen, the Pricing Strategy case is a frequent and challenging type of case study interview questions. You will be asked to determine the optimal price for a new product, service, or even an existing one facing market shifts. Your goal is to develop a logical pricing structure that aligns with the company's business objectives, cost structure, and market position.

This case is a favorite among strategy consulting firms and specialized pricing consultancies like Simon-Kucher & Partners. It directly assesses your ability to blend quantitative analysis with qualitative strategic thinking, evaluating how well you understand economic principles, market dynamics, and customer psychology to arrive at a defensible pricing recommendation.

Core Framework and Analysis

A successful pricing analysis requires a multi-faceted approach, balancing internal financial needs with external market realities. The core of your framework should investigate three primary pillars: the cost to produce, the value delivered to the customer, and the prices set by competitors. This ensures your final price is both profitable and competitive.

- Cost-Based Analysis: What is the total cost to produce and sell one unit (variable and fixed costs)? What is the minimum price needed to break even and achieve target profit margins?

- Value-Based Analysis: What tangible and intangible value does the product provide to different customer segments? How much are they willing to pay for this value? This often involves techniques like conjoint analysis or customer surveys.

- Competition-Based Analysis: What are competitors charging for similar products? How does our product's value proposition compare to theirs (e.g., premium features, better quality)?

A methodical breakdown is essential. Start by understanding the company’s overall objective (e.g., maximize market share, maximize profit) as this will guide which pricing strategy you prioritize.

Actionable Tips for Success

Resist the urge to suggest a single number immediately. Instead, outline the different pricing methodologies you will consider and explain your structured plan to the interviewer.

Strategic Insight: The most compelling pricing recommendations are not just a single price point but a coherent strategy. This includes considering different pricing models like subscription, freemium, or dynamic pricing, and justifying which fits the business best.

Begin your analysis by clarifying the pricing objective. Is the company trying to penetrate a new market, or is it trying to maximize profits from a loyal customer base? Analyze different customer segments and their willingness to pay, as this can lead to tiered pricing strategies. Finally, consider psychological effects like charm pricing ($9.99 vs. $10.00) or price anchoring to refine your recommendation. For more detailed breakdowns, you can explore other consulting case study examples on Soreno.ai.

4. Operations Optimization Case

A classic in the consulting world, the Operations Optimization case challenges you to improve a company's internal processes. This type of case study interview questions asks you to diagnose inefficiencies, reduce costs, or increase output by analyzing a specific operational workflow. Your goal is to identify bottlenecks and propose practical, impactful solutions that enhance performance.

This case is a favorite among firms with strong operations practices and industries like manufacturing, logistics, and healthcare. It directly tests your ability to think methodically, apply quantitative analysis to real-world processes, and balance strategic vision with implementation realities. You’ll need to deconstruct a system, pinpoint the weakest link, and recommend concrete changes.

Core Framework and Analysis

Your analysis should begin by mapping the end-to-end process to understand how value is created and where delays or costs accumulate. The objective is to move from a qualitative understanding to a quantitative diagnosis. A solid framework will explore the current process, identify constraints, and evaluate potential solutions.

- Process Mapping: What are the sequential steps in the operation? What is the capacity, time, and cost associated with each step?

- Bottleneck Identification: Which step is the primary constraint limiting overall system throughput? Use capacity analysis and data to pinpoint this "weakest link."

- Solution Brainstorming & Evaluation: What are the potential levers for improvement? This could include technology (automation), process changes (lean principles), or people (training). What are the costs, benefits, and risks of each solution?

This structured approach ensures you address the root cause of the problem rather than just its symptoms. The following video provides a helpful walkthrough of how to tackle a process improvement case.

Actionable Tips for Success

Resist the urge to suggest generic solutions like "add more machines" immediately. First, thoroughly understand the current state by asking clarifying questions about each step in the process.

Strategic Insight: The interviewer is testing your ability to be hypothesis-driven and data-oriented. A recommendation to invest millions in new equipment is weak without first proving that the targeted step is indeed the bottleneck.

Start by drawing a simple process flow diagram. Quantify everything: cycle times, labor costs per step, machine capacity, and defect rates. Once you've identified the bottleneck, brainstorm a range of solutions, from low-cost, quick fixes to long-term capital investments. Always conclude by considering the implementation challenges, such as change management, employee training, and potential disruption to ongoing operations, before making a final, well-rounded recommendation.

5. M&A Due Diligence Case

A frequent and complex scenario in both consulting and finance interviews, the M&A Due Diligence Case is one of the more challenging case study interview questions you may face. This case asks you to assess the viability of one company acquiring another. Your role is to analyze the strategic fit, financial attractiveness, and potential integration risks to recommend whether your client should proceed with the deal.

This case type is a favorite for investment banks like Goldman Sachs, corporate development teams, and top consulting firms. It tests a candidate’s ability to blend strategic thinking with financial analysis, evaluating not just the "why" behind an acquisition but also the "how much" and "what could go wrong." You'll need to demonstrate a comprehensive understanding of business valuation, market dynamics, and operational integration.

Core Framework and Analysis

Your analysis should start by establishing the strategic rationale for the acquisition before diving into financial modeling. A structured approach typically involves assessing the target company as a standalone entity, identifying potential synergies, and evaluating the risks and integration challenges. A thorough evaluation will cover these key areas:

- Strategic Rationale: Why is this acquisition being considered? Does it provide access to new markets, new technologies, or key talent? Does it help eliminate a competitor?

- Target Company Valuation & Synergies: What is the target company worth on its own? What are the potential revenue and cost synergies (e.g., cross-selling opportunities, economies of scale)?

- Risks and Integration: What are the major risks (e.g., overpaying, cultural clash, regulatory hurdles)? How feasible is the post-merger integration plan?

This methodical breakdown allows you to build a logical case for or against the acquisition, ensuring you cover all critical business and financial considerations.

Actionable Tips for Success

When you receive an M&A case, resist the temptation to immediately start crunching numbers. First, clarify the deal's primary objective and lay out your structured approach to evaluating the opportunity.

Strategic Insight: The most compelling M&A recommendations go beyond a simple valuation. They tell a story about how the combined entity will create more value than the two companies could apart. Focus on synergies and strategic fit.

Begin by assessing the target's market and competitive position to understand its intrinsic value. Next, quantify potential synergies, clearly labeling them as revenue or cost-based. Always perform a quick valuation using multiple methods if possible, such as comparable company analysis or a simple discounted cash flow (DCF). Finally, weigh the potential rewards against the significant risks of integration and cultural mismatch before delivering a clear "go" or "no-go" recommendation with supporting reasons. To see how these complex problems are structured in a live interview setting, explore this comprehensive McKinsey case interview guide on Soreno.ai.

6. Digital Transformation Case

A highly relevant and contemporary scenario, the Digital Transformation Case has become a staple in modern consulting interviews. This case study asks you to advise a traditional, often legacy, company on how to adapt to the digital age. Your role is to develop a strategy for navigating technological disruption, building new digital capabilities, and fundamentally transforming its business model to stay competitive.

This case type is increasingly used by top firms and technology-focused practices like Accenture because it tests a candidate's grasp of current technology trends, change management principles, and strategic vision. It requires you to balance innovation with practical implementation, showing you can guide an established organization through a period of significant uncertainty and change.

Core Framework and Analysis

A successful approach to a digital transformation case involves assessing the company's current state and then building a phased roadmap for the future. The analysis should be structured around understanding the internal gaps, external opportunities, and the organizational capacity for change. Key areas to investigate include the customer experience, internal operations, and the business model itself.

- Current State Assessment: What is the company's current digital maturity? Where are the key gaps in technology, skills, and processes? How do its capabilities compare to digitally native competitors?

- Transformation Strategy: What are the key digital initiatives to pursue (e.g., e-commerce, IoT, data analytics)? How should these be prioritized based on customer impact, business value, and feasibility?

- Implementation & Change Management: What is the high-level roadmap for implementation? What new skills and talent are needed? How will the company manage the cultural shift required for a successful transformation?

This systematic evaluation ensures you address both the "what" (the technology) and the "how" (the people and process changes) of digital transformation, leading to a more holistic and realistic recommendation.

Actionable Tips for Success

When faced with a digital transformation case, resist the urge to suggest every popular technology. Instead, ground your recommendations in the company’s specific business context and strategic goals. Clearly articulate your framework for evaluating and prioritizing initiatives.

Strategic Insight: The interviewer is looking for more than just tech buzzwords. They want to see if you can connect digital initiatives to tangible business outcomes like revenue growth, cost reduction, or improved customer satisfaction.

Start by identifying the core business problem that digital can solve. For example, is the goal to improve customer retention, streamline the supply chain, or create new revenue streams? Frame your solution around this problem. Finally, propose a phased approach, starting with "quick wins" to build momentum and demonstrate value, followed by longer-term, more foundational changes. This shows you understand the practical realities of driving change within a large organization.

Case Study Interview Questions Comparison

| Case Type | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Market Entry Strategy Case | Intermediate to Advanced; multi-step analysis involving market sizing, competition, and planning | Moderate to High; requires data, frameworks, financial modeling | Comprehensive market entry strategy with risk assessment and timeline | New market expansions; industry or geographic entry | Tests broad business acumen; adaptable frameworks; real consulting relevance |

| Profitability Decline Case | Beginner to Intermediate; structured root cause analysis with profit trees | Low to Moderate; focuses on quantitative data and diagnostics | Identification of profit drivers and actionable solutions | Firms experiencing profit drops or cost issues | Clear analytical structure; fundamental business relevance; good for beginners |

| Pricing Strategy Case | Intermediate; requires economic, competitive, and customer analysis | Moderate; involves market data and pricing models | Optimized pricing approach balancing value and costs | Product/service pricing decisions in competitive markets | Combines analytical and strategic insights; allows creativity |

| Operations Optimization Case | Intermediate; detailed process and bottleneck analysis with cost-benefit evaluation | Moderate; needs process data, technical insight, and technology assessment | Improved operational efficiency and cost reduction | Supply chain, manufacturing, service process improvements | Practical, measurable impact; relevant across industries |

| M&A Due Diligence Case | Advanced; complex financial modeling, strategic fit, and integration planning | High; requires detailed financials, risk analysis, and due diligence | Strategic acquisition decision supported by valuation and risk assessment | Corporate acquisitions; investment banking and strategy roles | Comprehensive, high-stakes; tests financial and strategic skills |

| Digital Transformation Case | Advanced; involves digital maturity, tech evaluation, and change management | High; needs technology insights, organizational change capabilities | Business model innovation and digital capability buildout | Companies undergoing technology disruption or innovation | Combines strategic and tech knowledge; future-focused; highly relevant today |

From Theory to Practice: Your Next Steps to Case Mastery

Navigating the landscape of case study interviews can feel like preparing for an intellectual marathon. We've dissected six of the most common archetypes, from the strategic foresight required for a Market Entry case to the detailed financial scrutiny of an M&A Due Diligence problem. Each example illustrates a different business challenge, yet they all converge on a single, powerful point: success is not about memorizing answers, but mastering a process.

The frameworks and strategies discussed for profitability, pricing, and operations are not rigid formulas. Instead, they are flexible toolkits designed to bring order to ambiguity. Your true differentiator will be your ability to adapt them on the fly, demonstrating a hypothesis-driven approach that cuts through complexity and gets to the core of the business issue.

Synthesizing Your Core Skills

The ultimate goal of any case interview is to simulate the real-world pressures of a high-stakes consulting or finance engagement. Interviewers are not just evaluating your analytical horsepower; they are assessing a complete skill set.

- Structured Thinking: Can you take a broad, open-ended problem and break it down into logical, manageable components? This is the foundation upon which every successful case is built.

- Quantitative Agility: Your ability to perform quick, accurate calculations and derive meaningful insights from data is non-negotiable. It demonstrates your comfort with the language of business.

- Business Acumen: Do you possess a genuine curiosity about how businesses operate? Your ability to ask insightful clarifying questions and connect disparate pieces of information showcases your commercial intuition.

- Communication & Presence: A brilliant analysis is useless if it cannot be communicated clearly and persuasively. Your ability to articulate your thought process and present a confident recommendation is just as critical as your math.

Building Your "Case Muscle Memory"

Understanding these case study interview questions is the essential first step, but it is only the beginning. True confidence is forged through deliberate, consistent practice. The key is to move from passive learning (reading articles) to active application (solving cases under pressure). This transition builds the mental "muscle memory" needed to perform when it counts.

By repeatedly applying frameworks, structuring problems, and presenting solutions, you internalize the process. The initial awkwardness of drawing an issue tree or calculating a break-even point gives way to fluid, second-nature execution. This is how you transform interview anxiety into an opportunity to showcase your strategic thinking and problem-solving prowess, securing the offer you've worked so hard to achieve.

Ready to put these strategies into action? Soreno provides an AI-powered platform with over 500 real-world cases and instant, personalized feedback to help you master every type of case study interview question. Start practicing with an AI interviewer today and get the targeted coaching you need to land your dream role at Soreno.