6 Consulting Case Interview Examples to Master in 2025

Break down 6 key consulting case interview examples. Learn the frameworks, analysis, and takeaways you need to ace your MBB interview.

The consulting case interview is more than a test; it's a simulation of the job itself. It’s where top firms like McKinsey, BCG, and Bain separate strong candidates from the rest by evaluating structured thinking, quantitative rigor, and business creativity under pressure. Mastering this format isn't just about memorizing frameworks; it's about understanding how to apply them dynamically to solve complex business problems. Success requires a deep, tactical knowledge of the most common challenges you will face.

This guide moves beyond generic advice to provide a strategic breakdown of the core consulting case interview examples you are almost certain to encounter. We will dissect the six fundamental case archetypes that form the backbone of the modern interview process, from initial market entry assessments to complex merger and acquisition scenarios. For each example, you will receive a detailed analysis, the essential frameworks to deploy, and critical takeaways that demonstrate you think like a seasoned consultant.

Our focus is on providing actionable insights and replicable methods. You will learn not just what to do, but why you are doing it and how to communicate your thought process effectively. This is your practical roadmap to deconstructing each case type, building the necessary analytical muscles, and developing the confidence needed to turn your next interview into a job offer.

1. Market Entry Case

The Market Entry case is a cornerstone of consulting interviews and a classic among consulting case interview examples. It asks a fundamental strategic question: should a company enter a new market? This could be a new product category, a different geographic region, or a new customer segment. These cases are designed to test your ability to structure an ambiguous problem, perform robust market analysis, and provide a clear, data-driven recommendation.

Top-tier firms like McKinsey & Company and BCG favor this case type because it mirrors real-world strategic projects. Success requires a methodical approach to deconstruct the problem into manageable components, evaluate risks and opportunities, and synthesize findings into a cohesive narrative.

Strategic Framework and Analysis

The core of a market entry analysis involves evaluating three critical areas: the market itself, the competition within it, and the company's capabilities to compete. A common framework is the Market-Competition-Company model.

- Market: What is the size of the opportunity? Is the market growing, stagnant, or declining? What are the key customer segments, and what are their unmet needs?

- Competition: Who are the major players? What is their market share? How are they likely to react to a new entrant? What are the primary barriers to entry (e.g., regulations, capital costs, brand loyalty)?

- Company: Does our company have the financial resources, operational capabilities, and brand strength to succeed? Does entering this market align with our overall corporate strategy? Can we create a sustainable competitive advantage?

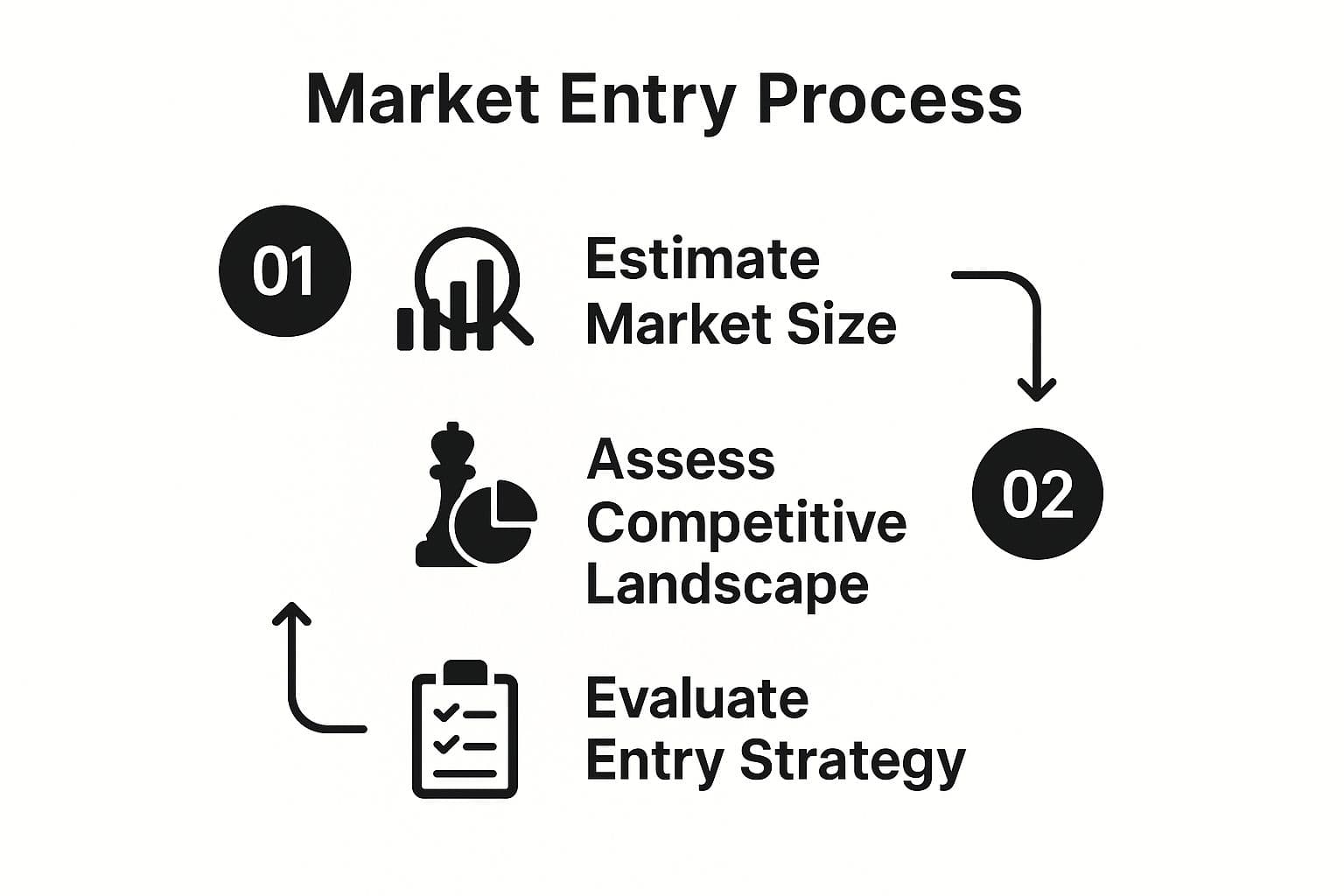

The following infographic illustrates the logical workflow for structuring a market entry case analysis.

This step-by-step process ensures your analysis is comprehensive, starting with the size of the prize before assessing the challenges and finally determining the best way forward.

Actionable Takeaways

To excel in a market entry case, you must go beyond the framework. It's not just about listing factors; it's about connecting them to a strategic decision.

Key Strategic Insight: The most compelling recommendations don't just say "yes" or "no." They specify how to enter (e.g., build, buy, or partner) and provide a high-level roadmap, including potential revenue projections and investment costs.

Always quantify your analysis wherever possible. For example, instead of saying the market is "large," estimate its value (e.g., "a $2 billion market growing at 5% annually"). Before concluding, consider the risks and create a final recommendation that acknowledges them while still being decisive.

2. Profitability Analysis Case

The Profitability Analysis case is a fundamental component of the consulting interview process and one of the most common consulting case interview examples. It centers on a core business problem: a company's profits are declining, and you must diagnose the root cause and recommend solutions. This case type directly tests your analytical horsepower, business intuition, and ability to structure a problem logically.

Firms like McKinsey & Company frequently use profitability cases because they simulate the high-stakes problem-solving that consultants perform daily. Whether it's a software company with shrinking margins or a retail chain with falling sales, your goal is to dissect the issue with precision and propose a clear, impactful path forward.

Strategic Framework and Analysis

The foundational framework for a profitability case is the simple yet powerful equation: Profit = Revenue - Costs. The key is to break this formula down into its constituent drivers to pinpoint the source of the decline. This structured decomposition prevents random guessing and ensures a comprehensive investigation.

- Revenue Drivers: Has revenue decreased? If so, why? This could be due to a drop in the number of units sold (volume) or a decrease in the price per unit. A further drill-down might explore issues by product line, customer segment, or geographic region.

- Cost Drivers: Have costs increased? If so, which ones? It's critical to separate costs into Fixed Costs (e.g., rent, salaries) and Variable Costs (e.g., raw materials, production labor). Understanding this split helps identify if the issue is related to operational inefficiency or broader structural costs.

This systematic approach, often called a "profit tree," allows you to isolate the problem area. For instance, you might discover that overall revenue is stable, but the cost of raw materials for a specific product has surged, eroding margins.

Actionable Takeaways

Excelling in a profitability case requires moving swiftly from diagnosis to a prioritized set of solutions. Your analysis must be data-driven, and your recommendations must be practical and tied directly to the problem you've identified.

Key Strategic Insight: Don't just identify the problem; quantify its impact and prioritize your proposed solutions based on potential impact and ease of implementation. A great candidate will suggest a mix of short-term fixes and long-term strategic shifts.

Always start by asking clarifying questions to get specific data points. For example, "Can you provide a breakdown of our revenue by major product line for the past three years?" Once you have a hypothesis, pressure-test it with more questions. Conclude with a clear recommendation that not only addresses the immediate profit decline but also positions the company for sustainable long-term health.

3. Market Sizing (Fermi) Case

The Market Sizing case, often called a Fermi problem, is a distinct and highly quantitative type of consulting case interview example. It challenges candidates to estimate a figure with limited information, such as the market size for residential windows in Canada or the number of golf balls sold annually in the United States. Named after physicist Enrico Fermi, who was renowned for his ability to make good approximate calculations with little or no actual data, these cases test your logical reasoning, structured thinking, and comfort with ambiguity.

Firms use these cases to evaluate a candidate's pure analytical horsepower. While market sizing can be a component of a larger strategic case like a Market Entry, it can also stand alone as a quick-fire test of your ability to break down a complex problem into a series of simple, manageable calculations.

Strategic Framework and Analysis

Success in a Market Sizing case hinges on creating a logical, defensible structure. There is no single correct framework, but most effective approaches are either top-down or bottom-up. The key is to clearly state your assumptions and build a calculation tree that is easy for the interviewer to follow.

- Top-Down Approach: Start with a large, known population and progressively narrow it down. For example, to estimate the U.S. dog food market, you would start with the U.S. population, estimate the number of households, then the percentage of households with dogs, and so on.

- Bottom-Up Approach: Begin with an individual unit and build up. For instance, to calculate the annual revenue of a single Starbucks store, you could estimate customers per hour, average spend per customer, and operating hours, then scale that up.

- Key Components: Regardless of the approach, you must deconstruct the problem. A typical structure involves Population -> Segmentation -> Consumption/Usage Frequency -> Price/Revenue per unit.

Clearly outlining your assumptions is paramount. For example, "I will assume the U.S. population is 330 million and the average household size is approximately 3 people, giving us 110 million households."

Actionable Takeaways

A strong candidate does more than just arrive at a number; they demonstrate commercial acumen throughout the process and sanity-check their conclusion. The final answer is less important than the logical path you take to get there.

Key Strategic Insight: Always conclude a market sizing exercise with a sanity check. Ask yourself, "Does this number make sense in the real world?" If estimating the revenue for a coffee shop, your final number shouldn't exceed that of a major corporation. This final step shows critical thinking and business judgment.

To stand out, use round numbers to simplify mental math and vocalize your thought process step-by-step. Break the problem into its smallest components, solve each one, and then synthesize them for a final answer. Acknowledge the limitations of your assumptions and suggest what data you would seek to refine your estimate if this were a real project.

4. Growth Strategy Case

The Growth Strategy case is a fundamental and frequently encountered challenge among consulting case interview examples. It centers on the core business question: how can a company grow its revenue or profit? The case asks candidates to explore various avenues for growth, such as launching new products, expanding into new markets, pursuing acquisitions, or optimizing current operations. These cases are designed to test your strategic creativity, business acumen, and ability to prioritize complex initiatives.

Firms like Bain & Company and Boston Consulting Group often use this case type because it directly reflects their work with clients seeking to expand their business. A strong performance requires a structured exploration of all potential growth levers, a quantitative assessment of their potential impact, and a clear, defensible recommendation.

Strategic Framework and Analysis

To solve a growth strategy case, you must dissect the problem into organic and inorganic growth pathways. A powerful tool for this is the Ansoff Matrix, which outlines four primary growth strategies based on products and markets. It helps ensure a comprehensive and MECE (Mutually Exclusive, Collectively Exhaustive) analysis.

- Organic Growth: How can we grow using our own resources? This includes market penetration (selling more of our current products to existing customers), market development (selling current products in new markets), and product development (creating new products for existing markets).

- Inorganic Growth: How can we grow by acquiring or partnering with other businesses? This often involves mergers and acquisitions (M&A) to gain market share, enter new geographies, or acquire new capabilities quickly.

- Prioritization: Which of these options offers the best return on investment? This requires evaluating the potential size of the opportunity, the costs and risks involved, and the company's capabilities to execute each strategy successfully.

Your analysis should compare these options, quantifying the potential revenue uplift, required investment, and associated risks for each path.

Actionable Takeaways

A superior answer in a growth strategy case moves beyond merely listing options. The goal is to build a compelling business case for a specific, sequenced growth plan.

Key Strategic Insight: The strongest recommendations prioritize growth initiatives into a logical roadmap. Instead of suggesting everything at once, propose a phased approach, like "First, maximize market penetration in our core markets (Phase 1), then use those profits to fund new product development (Phase 2)."

Always back your chosen strategy with numbers. For instance, estimate the revenue increase from each initiative (e.g., "Entering the West Coast market could generate an additional $50M in revenue within three years"). Conclude by outlining a high-level implementation plan, including key milestones and potential challenges, to demonstrate forward-thinking strategic vision.

5. Operations/Cost Reduction Case

The Operations/Cost Reduction case is another vital component in the library of consulting case interview examples. This case challenges you to diagnose inefficiencies and find ways to improve a company's bottom line by optimizing its internal processes. You might be asked to help a hospital reduce patient wait times, streamline a manufacturing plant's production line, or improve a call center's efficiency.

Firms like McKinsey, particularly within their Operations Practice, and those specializing in Lean/Six Sigma methodologies, use these cases frequently. They are designed to test your logical process thinking, quantitative skills, and ability to identify tangible opportunities for improvement within a complex system.

Strategic Framework and Analysis

A successful approach to a cost reduction case often involves a detailed process analysis. The goal is to map the existing process, identify bottlenecks or sources of waste, and then brainstorm targeted solutions. A powerful framework is to analyze costs by breaking them down into their core components.

- Process Mapping: Start by understanding the end-to-end process. What are the key steps, who is involved, and how long does each step take? For a manufacturing plant, this could be from raw material intake to final product shipment.

- Identify Bottlenecks and Waste: Where are the delays, redundancies, or unnecessary expenses? Use concepts like the "Seven Wastes" of lean manufacturing (e.g., waiting, overproduction, defects) to guide your investigation.

- Develop Solutions: Brainstorm solutions that address the root causes of inefficiency. These can be technology-based (automation), process-based (re-ordering steps), or people-based (retraining staff). Quantify the potential savings for each solution.

This video provides a practical walkthrough of how to structure and solve a cost reduction case, demonstrating the step-by-step analytical process.

Actionable Takeaways

To stand out in an operations case, you need to be both structured and creative. Your analysis should be grounded in the numbers, but your solutions should demonstrate practical business sense.

Key Strategic Insight: A superior recommendation provides a prioritized list of initiatives. It segments solutions into "quick wins" (low cost, high impact) and long-term strategic changes, showing you understand the practicalities of implementation.

Always focus on the financial impact. Don't just suggest a solution; estimate the cost to implement it and the expected annual savings. Conclude with a clear, prioritized action plan that balances potential savings against implementation costs and risks.

6. Merger & Acquisition (M&A) Case

The Merger & Acquisition (M&A) case is a complex and financially-oriented scenario among consulting case interview examples. It assesses whether a client should acquire another business, merge with a competitor, or divest a part of its own operations. These cases require a unique blend of strategic foresight, financial modeling, and an understanding of post-merger integration challenges.

Firms with strong private equity or corporate finance practices, such as Bain & Company and Oliver Wyman, often use M&A cases. They mirror high-stakes decisions where the potential for value creation or destruction is immense, demanding a rigorous and multi-faceted analysis from the candidate.

Strategic Framework and Analysis

A robust M&A analysis extends beyond a simple valuation. It must holistically evaluate the deal's strategic rationale, financial viability, and operational feasibility. A comprehensive framework should cover the target company, the acquirer, the potential synergies, and the overall deal structure.

- Target Company: What is its standalone value? Analyze its financial health, market position, and competitive advantages. Is it undervalued or overvalued?

- Acquirer (Client): What is the strategic rationale for this acquisition? Does it align with our long-term growth objectives? Do we have the financial capacity and operational expertise to execute the deal and integration?

- Synergies: Where will the value be created? Quantify potential revenue synergies (e.g., cross-selling, market access) and cost synergies (e.g., economies of scale, eliminating redundant functions). Are these estimates realistic?

- Risks and Integration: What are the major risks (e.g., cultural clash, overpaying, regulatory hurdles)? How complex will the post-merger integration be, and what is the plan to manage it effectively?

This structure ensures you first validate the target’s intrinsic worth and strategic fit before calculating the premium the client might be willing to pay based on expected synergies.

Actionable Takeaways

In an M&A case, the final recommendation is more than a "go" or "no-go" decision. It must be a nuanced conclusion that includes a specific price and the logic behind it, making it a critical component of these consulting case interview examples.

Key Strategic Insight: A strong answer doesn't just focus on the acquisition price. It provides a maximum justifiable offer price based on standalone value plus quantified synergies, while clearly outlining the critical assumptions and risks that could alter this valuation.

Always pressure-test your synergy estimates. Are they achievable, and what is the timeline to realize them? Conclude by weighing the potential value created against the significant risks of overpaying and failing at integration. A sophisticated answer might recommend the deal but only under specific conditions or with a detailed integration plan in place.

Case Interview Examples Comparison Table

| Case Type | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Market Entry Case | Medium to High | Moderate (market data, financials) | Strategic market entry decision | Entering new markets, product launches, expansions | Comprehensive core consulting skill test, creative solutions, real-world relevance |

| Profitability Analysis Case | Medium | Moderate (financial data, calculations) | Diagnosis of profit decline, solution roadmap | Identifying profit issues, cost/revenue optimization | Clear quantitative structure, multiple solution paths, business impact focused |

| Market Sizing (Fermi) Case | Low to Medium | Low (logical assumptions, rough data) | Approximate market or segment size | Quick market estimation, rough sizing exercises | Tests analytical thinking quickly, builds numerical confidence, easy to administer |

| Growth Strategy Case | Medium to High | High (business knowledge, financial modeling) | Growth plan and prioritization | Revenue growth planning, new product/market strategies | Encourages creativity, multiple valid solutions, prioritization practice |

| Operations/Cost Reduction Case | Medium | Moderate (process data, time studies) | Efficiency improvement, cost savings | Process optimization, cost cutting, operational efficiency | Concrete, measurable outcomes, operational focus, clear success metrics |

| Merger & Acquisition (M&A) Case | High | High (detailed financials, valuations) | Buy/sell/merge decision with integration plan | Corporate acquisitions, mergers, PE evaluations | Advanced skills tested, combines strategy and finance, high-stakes decisions |

From Theory to Practice: Accelerate Your Case Prep

Navigating the landscape of consulting interviews requires more than just theoretical knowledge; it demands the ability to apply that knowledge under pressure with structured, logical, and creative thinking. Throughout this guide, we've deconstructed six foundational consulting case interview examples, from Market Entry to Mergers & Acquisitions, providing you with the core frameworks and strategic insights needed to build a strong foundation.

You’ve seen how a Profitability case hinges on dissecting the Profit = (Price x Volume) - (Fixed + Variable Costs) equation, and how a Market Sizing case is less about the final number and more about the defensible logic behind your assumptions. Each archetype tests a different facet of your business acumen.

Key Learnings to Internalize

Mastering these cases is about recognizing patterns and adapting your approach. Remember these critical takeaways:

- Structure is Your Anchor: A clear, MECE (Mutually Exclusive, Collectively Exhaustive) framework isn't just a starting point; it's the guide that prevents you from getting lost in the details. It demonstrates to the interviewer that you can handle ambiguity with a logical process.

- Ask Clarifying Questions: The initial prompt is intentionally broad. Your ability to ask insightful, clarifying questions at the outset is what separates top candidates. This is your chance to scope the problem and demonstrate your proactive, hypothesis-driven mindset.

- Communicate Your "So What": Data without insight is just noise. For every calculation you make or piece of information you analyze, you must connect it back to the client's core problem. Always answer the "so what?" to show you're focused on delivering actionable recommendations.

Moving from Knowledge to Mastery

Understanding these consulting case interview examples is step one. The crucial next step is deliberate, consistent practice. The goal is to internalize these frameworks so deeply that they become second nature, freeing up your mental bandwidth to focus on generating unique insights during the actual interview. True mastery comes from repetition, where you encounter a wide variety of scenarios and learn to pivot your strategy in real-time.

This is where the real work begins. You need to simulate the interview environment as closely as possible, forcing yourself to think on your feet, structure your thoughts out loud, and defend your conclusions. The gap between reading about a case and solving one live is significant, and bridging it is the key to securing an offer. Each practice case you complete is another step toward turning interview anxiety into the quiet confidence that interviewers look for. Your journey from a promising candidate to a compelling hire is paved with practice.

Ready to put these concepts into action and get the reps you need? Soreno provides an on-demand, AI-powered platform with over 500 cases, allowing you to practice anytime, anywhere, and receive instant, MBB-calibre feedback on your performance. Stop just reading about cases and start mastering them by visiting Soreno to accelerate your preparation.