Your Guide to Dominating the Frameworks Case Interview

Master the frameworks case interview with our guide on core models, practical application, and proven strategies to structure your thinking and land the offer.

Think of a framework as your blueprint for tackling a tough business problem in a case interview. It's the difference between guessing your way through a maze and having a reliable map. Instead of throwing random ideas at the wall, a framework gives you a structured way to break the problem down, just like a detective methodically gathers clues to solve a crime.

These frameworks are flexible tools, not rigid rules. Their whole purpose is to help you analyze a business challenge logically and make sure you don't miss anything important.

What Are Case Frameworks and Why Do They Matter?

At its core, a case interview framework is simply a mental model for deconstructing a big, vague business prompt into smaller, bite-sized pieces.

Let's say the interviewer asks you to figure out why a company's profits are suddenly dropping. Without a framework, your mind might jump all over the place. You might blurt out, "Maybe their marketing is failing?" or "Are the products too expensive?" This kind of scattered thinking is a huge red flag for interviewers because it's inefficient and likely misses the real root cause.

A framework gives you a systematic path forward. It's a checklist that ensures you cover all the critical bases. For a closer look at how these scenarios unfold, you can explore in-depth what a case study interview is all about. https://soreno.ai/articles/what-is-a-case-study-interview

The Power of Structured Thinking

Using a framework from the get-go shows the interviewer you can think like a real consultant. Instead of a messy brainstorm, you can confidently open the case by saying something like, "To understand this profitability decline, I'd like to start by looking at the two main drivers: revenues and costs. First, I'll break down the revenue side, and then I'll move on to the cost structure."

This structured approach instantly proves that you are:

- Logical and organized: You know how to create a clear roadmap to a solution.

- Comprehensive: You won't accidentally overlook a critical part of the business problem.

- Hypothesis-driven: You can form smart, initial guesses and then test them with data.

A framework isn't about memorizing the 'right' answer. It's about demonstrating a reliable process for reaching a well-reasoned conclusion, no matter what problem you're given.

To give you a clearer picture, here’s a quick overview of the most common frameworks you'll encounter and what they're used for.

Common Case Interview Frameworks at a Glance

| Framework Type | Primary Business Question | Example Case Scenario |

|---|---|---|

| Profitability | Why are profits increasing or decreasing? | A CPG company's flagship snack brand has seen profits drop by 15% in the last year. |

| 3 Cs / 4 Ps | How can we improve our marketing strategy? | A fashion retailer wants to launch a new line of sustainable clothing. |

| Value Chain | Where in our operations can we cut costs? | An airline is facing rising fuel costs and wants to improve efficiency. |

| Porter’s 5 Forces | Is this an attractive market to enter? | A tech startup is considering entering the competitive food delivery market. |

| Market Sizing | What is the potential size of this market? | How many electric vehicle charging stations are needed in California? |

| M&A Framework | Should our company acquire this target? | A large pharmaceutical firm is looking to buy a smaller biotech company. |

These are the heavy hitters. Understanding when and how to apply them is the foundation of acing your case interviews.

The MECE Principle: Your Secret Weapon

The secret sauce that makes every good framework work is the MECE principle. It’s a classic consulting term that stands for Mutually Exclusive, Collectively Exhaustive. Sounds a bit technical, but the concept is actually very simple.

-

Mutually Exclusive (ME): Each bucket in your framework should be separate and not overlap. For instance, if you're analyzing costs, you wouldn't list "employee salaries" and "labor costs" as two different top-level categories, since salaries are a part of labor costs. This keeps your analysis clean and prevents you from double-counting.

-

Collectively Exhaustive (CE): Your buckets, when added together, should cover all the possible aspects of the problem. If you’re looking at revenue, you need to make sure you've considered every way the company makes money so that nothing significant gets left out.

Think of it like sorting laundry. You have distinct piles for whites, darks, and delicates (mutually exclusive), and together, those piles account for all the clothes you need to wash (collectively exhaustive). Applying MECE to your case frameworks ensures your analysis is tidy, complete, and incredibly easy for the interviewer to follow.

The Core Frameworks Every Candidate Must Master

Think of these core frameworks as your essential toolkit. You don't need to memorize dozens of them, but mastering a handful of reliable, powerful ones is non-negotiable for any serious candidate. They’re the fundamental building blocks of structured thinking that will carry you through the vast majority of your interviews.

Just like a chef masters sautéing and roasting before attempting complex dishes, you need to internalize these foundational structures. They give you the confidence to dissect any problem, no matter how intimidating it first seems. Let's break down the absolute must-knows.

The Profitability Framework: The Cornerstone of Business

If you only master one framework, make it this one. The profitability framework is the undisputed champion in the frameworks case interview world because nearly every business problem, deep down, connects back to the bottom line. It’s elegant in its simplicity but incredibly powerful when you put it to work.

The core formula is as simple as it gets: Profit = Revenue – Costs. Its true genius lies in breaking this equation down into a logical decision tree to diagnose the root cause of a financial problem.

This isn't just theory; industry analyses show the profitability framework appears in over 40% of all cases. Why? Because it directly mirrors the real-world challenges that clients of firms like McKinsey, BCG, and Bain face every day. To dig deeper, you can explore more insights on popular case interview frameworks and see why this structure is so critical.

To apply it, you’ll want to create two main branches for your analysis:

-

The Revenue Side: How is money coming in?

- Price per unit: Have prices changed? Are we using different pricing tiers?

- Number of units sold: Has sales volume dropped? Is there a shift in the product mix?

-

The Cost Side: Where is the money going?

- Fixed Costs: These don’t change with production volume (think rent, salaries, insurance).

- Variable Costs: These fluctuate directly with production (like raw materials, shipping, or hourly wages).

By methodically walking down each branch of this tree, you can pinpoint exactly where the problem lies—whether it's a drop in sales volume, a spike in raw material costs, or bloated administrative overhead.

The 3Cs Framework: A Complete Business Snapshot

When the case isn't strictly about a profit decline but a broader strategic question—like "How should we respond to a new competitor?" or "Should we launch this new product?"—the 3Cs framework is your go-to starting point. It gives you a holistic, 360-degree view of the business landscape.

The 3Cs are:

- Company: What are our internal strengths and weaknesses? This covers everything from product lines and brand reputation to our financial health and operational muscle.

- Customers: Who are we really serving? Here, you’ll want to explore customer segments, what they need, how they buy, and how sensitive they are to price. Have their tastes changed?

- Competition: Who are we up against? This means analyzing market share, competitors' products, their pricing strategies, and how they might react to our moves.

Think of the 3Cs as setting up the board before a chess match. You need to understand your pieces (Company), your opponent's pieces (Competition), and the rules of the game defined by the buyers (Customers). This framework ensures you're not making a move in a vacuum.

Porter’s Five Forces: Sizing Up the Industry

While the 3Cs framework looks at your direct competition, Porter's Five Forces zooms out to analyze the entire industry structure. It’s the perfect tool for cases about market entry, figuring out an industry's long-term appeal, or understanding why an industry is getting more or less profitable over time.

This framework helps you answer the big question: "Is this a good industry to be in?" It forces you to look beyond your direct rivals and consider the broader power dynamics at play.

The five forces you’ll analyze are:

- Threat of New Entrants: How easy is it for new players to set up shop? High barriers to entry, like huge startup costs or strong patents, make an industry more attractive for those already in it.

- Bargaining Power of Buyers: How much leverage do customers have to drive down prices? If buyers are few and powerful or can easily switch, their power is high.

- Bargaining Power of Suppliers: How much power do suppliers have to raise their prices? If there are only a couple of suppliers for a critical component, their power is high.

- Threat of Substitute Products or Services: How likely are customers to switch to a totally different type of solution? For example, video conferencing is a substitute for business travel.

- Rivalry Among Existing Competitors: How intense is the competition between the current players? A market with many equally-sized companies often leads to vicious price wars and thin margins.

By walking through these five areas, you develop a sophisticated read on an industry's competitive intensity and profit potential, which is absolutely critical for making smart strategic recommendations.

Frameworks for Growth Strategy and Market Analysis

Sooner or later, you'll move past internal problems like profitability and face bigger, forward-looking questions. The interviewer will want to see how you think about major strategic moves like launching a new product, expanding into a new country, or buying another company. This is where growth and market analysis frameworks come into play.

Think of these as your roadmap for navigating the unknown. They give you a structured way to break down complex, high-stakes decisions into manageable pieces, helping you build a recommendation that’s both logical and persuasive.

The Art of the Guesstimate: Market Sizing

One of the most classic—and sometimes dreaded—case interview tasks is market sizing. An interviewer might casually ask, "How many electric scooters are there in Chicago?" or "What's the annual market size for dog food in Canada?" They don't expect you to know the answer; they want to see how you figure it out.

There are two main ways to tackle this:

- Top-Down: Start with the biggest possible number and whittle it down. For a city-based question, you might begin with the total population, then segment by age, income, and likelihood to use the product.

- Bottom-Up: Start with a single point and build up. You could estimate the sales of one local coffee shop, then multiply that by the number of similar shops in the city to estimate the total market.

These are often called "Fermi problems," named after the physicist Enrico Fermi who was famous for making surprisingly accurate estimates with limited information. For example, a quick global market size might start with the world's 8 billion people. Divide that by an average household size of 2.5, and you get 3.2 billion households. From there, you can start applying assumptions about who would buy the product. It’s all about logical, defensible assumptions.

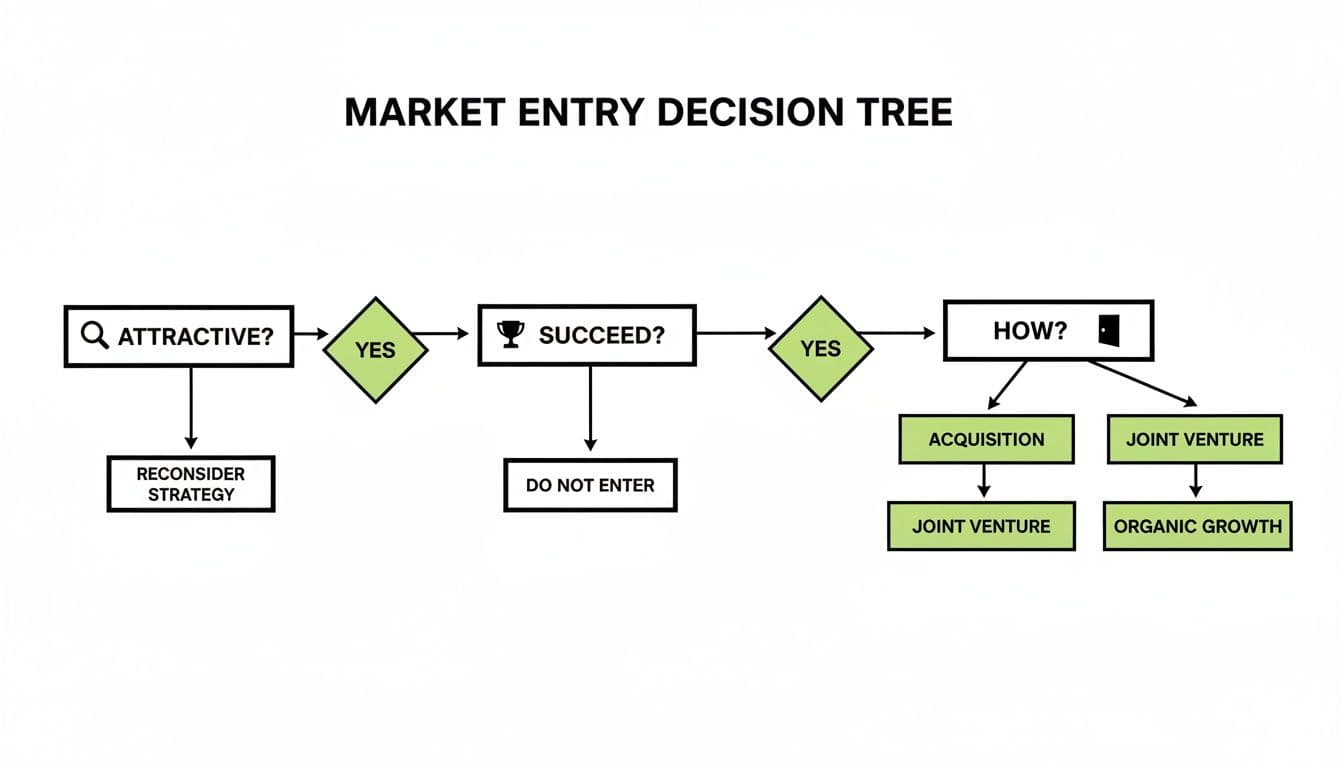

Should We Go for It? Market Entry Decisions

When the core question is, “Should our client enter this new market?” you need a reliable checklist. The Market Entry framework is perfect for this, guiding you through a sequence of critical questions to arrive at a clear go/no-go decision.

The best way to think about this is like a flowchart. You have to get a "yes" at each stage to proceed. If you hit a "no," you have a strong reason to recommend against the move.

Here's how you can structure your thinking:

- The Market Itself: First off, is this an attractive sandbox to play in? Look at the market's size, its growth rate, and how profitable it is for the current players.

- Our Capabilities: Next, do we have what it takes to win? Assess if the client’s brand, products, and operational muscle are a good fit for this new environment.

- The Financials: Does the math work out? You'll need to run some numbers on potential revenue, the costs to get started, and what the return on investment looks like.

- How to Enter: If the first three look good, what's the best way in? The main options are building from the ground up, acquiring an existing company, or partnering with a local player in a joint venture.

To really nail this part, you need to understand the landscape. Knowing some essential research techniques to develop a successful go-to-market strategy can give you a serious edge here.

To Buy or Not to Buy: Mergers & Acquisitions (M&A)

An M&A case is a specific type of market entry question where the client is considering buying another company. It's a high-stakes decision, and your job is to systematically evaluate if the deal makes sense. A solid M&A framework ensures you look at the deal from every important angle.

A thorough M&A analysis boils down to four key pillars:

- The Target: Is the company being bought a good asset on its own? You need to dig into its financial health, competitive position, and the quality of its leadership.

- The Market: How attractive is the industry the target operates in? This involves the same analysis of size, growth, and competition from the market entry framework.

- The Buyer: Why does our client want to make this purchase in the first place? Get to the root of their strategic goal. Are they trying to buy growth, acquire new tech, or take a competitor off the board?

- Synergies: This is where the magic happens—or doesn't. You absolutely have to ask: How will these two companies be worth more together than they are apart? This means calculating potential cost savings (like cutting duplicate HR departments) and new revenue opportunities (like cross-selling products to each other's customers).

By applying these structured approaches, you can transform a huge, intimidating question about growth into a clear, step-by-step analysis. If you want to go deeper on this topic, our guide on the go-to-market strategy framework is a great next step.

How to Choose and Adapt Your Framework Under Pressure

Knowing the frameworks is one thing. Actually picking the right one in the heat of a frameworks case interview and making it work for the specific problem in front of you? That's the real skill.

The biggest trap candidates fall into is treating frameworks like a rigid script. They hear a prompt and immediately force-fit it into a textbook model, which is a lot like using a hammer to turn a screw. It’s clumsy, and it shows you’re not really listening.

Top performers, on the other hand, treat frameworks as a starting point—a mental scaffolding to build upon. The key is to listen carefully to the case prompt for trigger words. If you hear "declining profits," your mind should immediately jump to the Profitability framework. A prompt about "entering a new country" is a clear signal for a Market Entry structure. These cues are your roadmap.

From Rigid Scripts to Flexible Thinking

The art of the case interview is in blending and customizing. A case is almost never a neat, tidy problem that fits perfectly into a single box. A market entry case can quickly morph into a discussion about pricing, or even a potential acquisition. This is where the best candidates shine.

They build a custom structure by pulling pieces from different frameworks. You might start with a Market Entry framework to assess the market size and growth, then pull in Porter's Five Forces to really dig into the competitive landscape. A few minutes later, you could be building a quick Market Sizing model to put a number on the opportunity.

This approach shows your interviewer something crucial: you're not just reciting a memorized model. You’re actively and thoughtfully solving their client's problem.

The goal isn't to show you know the name of a framework. It's to prove you understand the logic behind it and can tailor that logic to create a unique, relevant structure for the case at hand.

Listening for Clues and Customizing Your Approach

Your ability to adapt starts the second the interviewer stops talking. The words they use are loaded with clues about which business levers matter most.

Here’s how to translate those clues into a tailored structure:

-

Prompt Keyword: "A CPG client's revenue has been flat for three years."

- Starting Point: Profitability Framework, with a laser focus on the revenue side of the equation.

- Customization: Don’t just stop at revenue. Break it down into its core components:

Price x Volume. Then, you can segment volume by product line, customer type, and geographic region to diagnose exactly where the stagnation is coming from.

-

Prompt Keyword: "Should a tech company acquire a smaller AI startup?"

- Starting Point: M&A Framework.

- Customization: The real value here is in the synergies. Your structure should focus on questions like: How can the tech company's distribution channels boost the startup's sales? Will the startup's technology cut the acquirer's R&D costs? Quantify those benefits.

For instance, the 3Cs framework—Company, Customers, Competition—is an incredibly versatile tool that forms the foundation for roughly 35% of broad business strategy cases. If an M&A question comes up, you can expand the 3Cs to include the market size (e.g., a $10B market growing at 8% CAGR), the target's attractiveness (synergies that could create a 20% revenue uplift), and the buyer’s core strategic goals.

To help you get a feel for this, the table below maps common case prompts to the most logical starting frameworks.

Choosing Your Framework Based on Case Prompts

| Case Prompt Keyword | Primary Framework to Consider | Key Customization Tip |

|---|---|---|

| "Profits are down" / "Costs are up" | Profitability Framework | Isolate revenue vs. cost issues first. Drill down into specific cost buckets (fixed vs. variable) or revenue streams. |

| "Should we enter a new market?" | Market Entry Framework | Combine with Market Sizing to quantify the opportunity and Porter's Five Forces to assess competitive intensity. |

| "Should we launch this new product?" | 3Cs & 4Ps (Product, Price, Place, Promotion) | Focus on customer segmentation and competitive response. How will incumbents react to your launch? |

| "How can we grow?" / "Revenue is flat" | Business Situation Framework / 3Cs | Segment growth levers: organic (new products, new markets) vs. inorganic (acquisitions). |

| "Should we acquire Company X?" | M&A Framework | Prioritize synergies. Quantify both cost and revenue synergies and create a bucket for risks/integration challenges. |

| "How many..." / "Estimate the size of..." | Market Sizing | Always sanity-check your assumptions. Use a top-down and a bottom-up approach if time permits. |

Think of this table not as a set of rules, but as a guide to train your instincts. With practice, making these connections becomes second nature.

This decision-tree visual shows how you might structure a classic Market Entry case, moving from the big picture to the tactical details.

As the flowchart shows, a good structure breaks a massive, ambiguous question into a series of smaller, logical questions that guide you toward a well-supported recommendation.

Of course, thinking this clearly under pressure is a skill that needs to be developed. To sharpen your ability to perform in these high-stakes moments, check out our guide on how to think on your feet. And as you practice tailoring your frameworks, remember that the interviewer is also testing your composure. For more advice on using structure to tackle tough questions, you might find this resource on how to answer difficult interview questions like a pro really helpful.

Common Framework Mistakes That Weaken Your Case

Knowing the names of the frameworks is one thing. Actually using them gracefully under pressure in a frameworks case interview is a whole different ball game. I've seen countless sharp candidates stumble right here, not because they didn't know the material, but because they fell into a few predictable traps.

Getting this right is what separates someone who sounds like they're reciting a textbook from a genuine problem-solver. Let's walk through the most common slip-ups and how you can sidestep them.

Framework Dumping

This is hands down the most common and cringeworthy mistake. Framework dumping is when you mechanically list the components of a framework without connecting it to the problem you were just given. It comes across as robotic and shows the interviewer you're not really thinking, just regurgitating.

- Before (Weak): "To solve this, I will use Porter's Five Forces. First, I'll look at the threat of new entrants, then buyer power..."

- After (Strong): "This sounds like a market attractiveness question, so I want to get a handle on the competitive intensity here. To do that, I'll start by looking at the threat of new players and the power customers have, since those feel like the biggest immediate risks for our client."

See the difference? The second version shows you're actually thinking. You're tailoring the tool to the job, not just swinging a hammer because it's the only tool you know. That small tweak in how you say it makes a world of difference.

Boiling the Ocean

The second classic mistake is trying to analyze everything with equal weight. You might create a perfectly structured, MECE framework, but then you get bogged down in the weeds, chasing down details that have almost no impact on the final answer. We call this "boiling the ocean"—a massive effort for a tiny result.

A great framework isn't just comprehensive; it's prioritized. Your job is to find the 20% of drivers that account for 80% of the problem's impact and focus your energy there.

The trick is to start with a hypothesis. Ask yourself, "What are the one or two things that will really move the needle here?" Then, use your framework to stress-test that idea, focusing on the parts that will prove or disprove it fastest.

Failing to State Assumptions

In any case, you're going to have to make some educated guesses, especially in market sizing. The mistake isn’t making an assumption—it’s failing to say it out loud and briefly explain why you're making it. If you keep your assumptions in your head, the interviewer has no idea how you got to your answer.

Whenever you need to estimate something, follow this simple, three-step process:

- State it clearly: "I'm going to assume that 70% of the urban population owns a smartphone."

- Justify it quickly: "This feels reasonable given how central phones are to city life and current tech trends."

- Check in with your interviewer: "Does that sound like a reasonable starting point to you?"

This brings the interviewer into your thought process. It makes it collaborative and gives them a chance to nudge you back on track if your guess is way off.

Disconnecting the Recommendation

The last major pitfall is presenting a final recommendation that seems to come out of nowhere. You can do a brilliant job structuring the problem, but if your conclusion doesn't clearly flow from the analysis you just did, all that hard work is for nothing.

Your final summary needs to tell a story that connects the dots. Use linking phrases like, "Based on our analysis of the cost structure..." or "Because the competitive deep-dive revealed..." This explicitly ties your findings to your advice, creating a conclusion that feels logical, powerful, and earned.

Your Final Checklist for Case Interview Success

As you gear up for the big day, let's boil everything down into a simple, actionable game plan. If you remember only one thing, make it this: frameworks are your tools for thinking, not rigid scripts to be recited from memory. The real magic in a frameworks case interview happens when you show you can adapt, listen carefully, and build a logical solution right there on the spot.

Think of it like an expert chef on a cooking show. They don't walk in with a single memorized recipe. Instead, they rely on fundamental techniques—sautéing, braising, balancing flavors—that they can creatively adapt to whatever surprise ingredients they're given. Your frameworks are your techniques. Your ability to mix, match, and customize them is what will set you apart.

The Five Steps to Execute in the Room

When the interviewer starts the clock, your adrenaline will be pumping. Having a clear, simple plan is what will keep you from getting flustered. This five-step checklist is your guide, from the moment you hear the prompt to your final handshake. Following this sequence keeps you in the driver's seat and makes it easy to showcase your thinking.

This process is your safety net. It keeps you grounded and ensures your analysis flows in a way that’s logical and easy for the interviewer to follow along.

Remember, the interviewer isn't just grading your final answer; they're grading your process. A calm, structured, and collaborative approach is far more impressive than a frantic dash to a conclusion, even if that conclusion happens to be right.

Your In-Interview Action Plan

Here is the exact sequence to nail in the interview:

- Clarify the Prompt: Before you even think about a framework, make sure you understand the core problem. Ask clarifying questions about the client’s ultimate goal, any jargon you don't recognize, and how success will be measured.

- Pause and Structure: Take a moment. It's okay to be silent. Use that time to sketch out a custom framework on your paper, thinking hard about which issues are most important to tackle first.

- Introduce Your Framework: Turn your notepad toward the interviewer and walk them through your plan. Don't just say, "I'm using a profitability framework." Instead, explain your logic and tell them why you believe certain areas are the most critical starting points.

- Guide the Analysis: This is where you lead the conversation. Move through your structure one piece at a time. State your hypothesis, ask for the data you need to test it, and summarize what you're learning as you go.

- Deliver a Powerful Recommendation: Wrap it all up with a clear, confident recommendation that links directly back to your analysis. Start with your main point, back it up with two or three key findings, and briefly touch on any potential risks.

Frequently Asked Questions About Case Frameworks

Even after you've studied the basics, it's normal to have some nagging questions about how to actually use these frameworks when the pressure is on. Let's walk through some of the most common worries I hear from candidates, so you can handle any curveballs in your next interview.

How Many Frameworks Do I Really Need to Know?

Honestly, you don’t need to memorize a laundry list of them. Focus on deeply understanding just a few core ones: Profitability, the 3Cs, and Market Sizing. These are the absolute workhorses. Get comfortable with them, and you’ll have the right building blocks for over 80% of the cases you'll ever see.

The goal here is always depth over breadth. An interviewer will be far more impressed by how you can creatively adapt one of these core tools than by you rattling off a dozen niche frameworks you can't actually use well.

What If the Case Doesn't Fit a Standard Framework?

This is where the great candidates separate themselves from the good ones. If a standard framework feels like you're trying to jam a square peg into a round hole, don't force it. Build your own.

This is your moment to show you can really think on your feet. You can break down the problem using a simple, logical structure you create on the spot. For instance:

- Internal vs. External Factors: First, look at everything the company can control, then analyze the outside market forces it has to deal with.

- Short-Term vs. Long-Term Actions: Split your analysis into quick wins versus bigger, long-term strategic moves.

The key is to walk the interviewer through your thinking. They care far more about your ability to create a logical, tailored structure than your ability to regurgitate a textbook model. This is what real consulting work looks like.

The best candidates don't just use frameworks; they build them. When you get an oddball case, just explain your custom approach. You could say, "This is an interesting problem. To structure my thinking, I'd like to start by looking at the company's internal capabilities and then shift to the external market trends. Does that sound like a reasonable way to begin?"

Should I Announce the Name of the Framework I’m Using?

My advice is almost always no. It’s better to show, not tell.

Explicitly naming a framework—"Okay, I'm going to use the Profitability Framework"—can come across as academic and a bit robotic. It breaks the natural flow of the conversation.

Instead, just weave the logic directly into your opening. Rather than naming the framework, say something like, "To get to the root of this profit decline, I'd like to start by exploring the revenue side of the equation. After that, I’ll dig into the cost structure."

This shows the interviewer that you've internalized the principles of the framework, not just memorized its name. And that's what they're really testing.

Ready to stop memorizing and start mastering? Soreno provides unlimited, on-demand practice with an AI interviewer trained on MBB standards. Get instant, personalized feedback on your structure, communication, and business insight to turn theory into offers. Start your free trial.