How to Get into Venture Capital A Realistic Guide

Discover how to get into venture capital with proven strategies. Our guide covers networking, crafting your story, and mastering the VC interview process.

Breaking into venture capital is a game you start playing long before you ever get an offer. It’s less about having the perfect resume and more about proving you can think and act like an investor right now. It all boils down to three things: having deep sector knowledge, sharp analytical skills, and a powerful network built on real relationships. Nail these, and you're on the right track.

Understanding the Venture Capital Playing Field

Before you even think about firing off your resume, you need to get the lay of the land. Venture capital isn't one-size-fits-all; it's a sprawling ecosystem filled with firms that have their own unique cultures, investment theses, and ways of operating. Figuring out these nuances is your first move—it’s how you’ll position yourself to win.

The venture world is notoriously cyclical and heavily influenced by a few big winners. While global venture funding recently bounced back to hit $425 billion across more than 24,000 private companies, that money isn't spread evenly. U.S. startups snagged $274 billion, a massive 64% of the total pie, with AI companies alone raising nearly half of all funding.

For anyone trying to break in, the message is clear: understanding emerging tech trends isn't just a nice-to-have, it’s the table stakes.

Key Roles and Responsibilities

VC firms are typically small, tight-knit teams. Your day-to-day will be completely defined by your role, and while the titles might differ slightly from fund to fund, the core functions are pretty standard. Knowing these roles helps you aim for the right entry point based on where you are in your career.

Here's a quick look at the typical roles you'll find inside a VC fund, what they do, and who usually fills them.

Key Venture Capital Roles and Responsibilities

| Role | Primary Responsibilities | Typical Background |

|---|---|---|

| Analyst | The fund's analytical backbone. Handles market research, financial modeling, and supports due diligence. | Recent graduates, former consultants, or investment banking analysts. |

| Associate | Sources new deals, meets with founders, and helps manage portfolio company relationships. Deeply involved in evaluating potential investments. | 2-4 years of experience in startups, tech, IB, or consulting. |

| Principal/VP | Starts to lead investment deals. Expected to have a strong network, a clear thesis, and the ability to win competitive rounds. | Former associates, experienced operators, or founders. |

| Partner | The final decision-makers. Sets firm strategy, raises new funds from LPs, and sits on the boards of portfolio companies. | Seasoned investors, successful entrepreneurs, or senior industry execs. |

Getting a handle on this structure is the first step in mapping out your own path into the industry.

The Different Flavors of VC Firms

It's also crucial to remember that no two VC funds are exactly alike. Their structure, where they get their money, and their investment mandate create vastly different work environments.

For instance, some firms are purely focused on early-stage deals (Seed and Series A), where success hinges on your ability to judge a team and a market opportunity before there's much data. Others are all about growth equity, where you're doing deep financial analysis on more mature businesses. To really get a feel for this, you should understand the different types of VC firms like Corporate VC vs. Independent VCs.

The reality of a VC job is a lot less glamorous than the tech headlines suggest. It’s not just about hearing visionary pitches. The bulk of the work is the rigorous, behind-the-scenes grind of due diligence—sifting through data rooms, doing reference checks, and getting into the weeds of a venture capital term sheet. That analytical grit is what really separates the great investors from the rest.

Finding Your Unique Path into VC

Let's clear something up right away: there's no single, secret handshake to get into venture capital. The industry is full of people from wildly different backgrounds, and your journey will be defined by the unique skills you bring to the table. Forget about a one-size-fits-all approach. There are several proven paths, and the trick is finding the one that fits you.

Your first move is to take an honest look at your own resume and experiences. The goal isn't to check a box; it's to find the route that turns your background into a genuine competitive advantage for a VC firm.

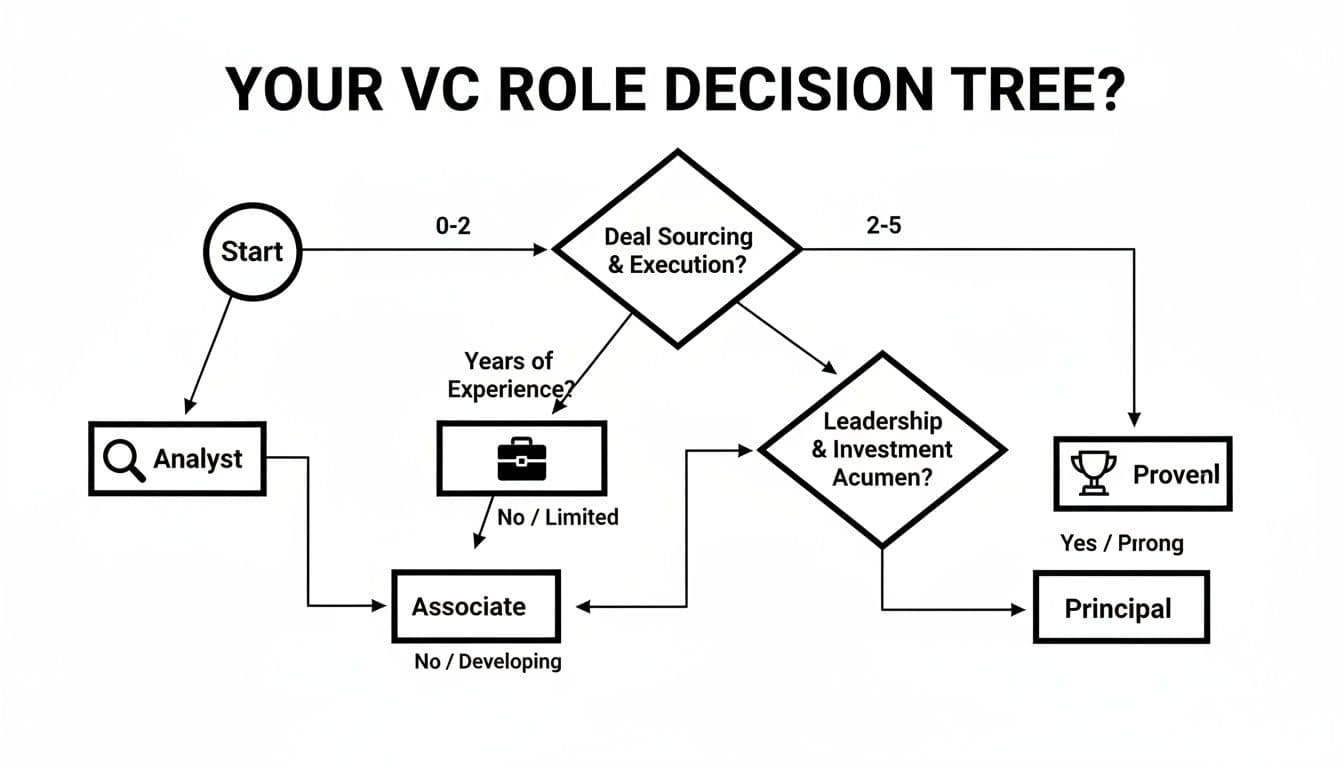

This decision tree can help you visualize where you might fit in based on what you’ve done so far.

It’s a simple way to see how different levels of experience, deal-sourcing chops, and leadership skills tend to map to roles like Analyst, Associate, or Principal.

The Classic Finance and Consulting Route

This is the most traditional path for a reason. If you’ve cut your teeth in the high-stakes world of investment banking, private equity, or strategy consulting, you’ve already been through a demanding training ground. You’re fluent in financial modeling, market analysis, and the kind of rigorous due diligence that VCs rely on every day.

This kind of background is especially gold at later-stage or growth equity funds, where analytical firepower is non-negotiable. Your ability to tear apart a business model and quantify risk is your superpower.

The big hurdle? You have to prove you have the "startup mindset." You’ll need to show you’re more than just a numbers person and can truly grasp the messy, visionary, and often unquantifiable reality of building a company from scratch.

The Powerful Operator Path

An increasingly popular—and highly valued—way in is the "operator" path. This is for people who have been in the startup trenches. Think former founders, early-stage product managers, or key employees who helped scale a company from 10 to 1,000 people.

VCs crave operators for their real-world wisdom. You know what it feels like to hunt for product-market fit, execute a go-to-market strategy, and survive the chaos of hypergrowth. That empathy for the founder’s journey is something you can't learn in a classroom or from a spreadsheet.

When you're interviewing, don't just list your accomplishments. Frame your experience around the strategic lessons you learned. What patterns did you notice in winning teams? What did you learn about company building? How would you use that insight to find the next great startup?

This lived experience makes you an instantly credible partner for founders and a huge asset to any fund, especially those investing at the early stages.

Alternative and Specialized Entry Points

The VC world is getting bigger and more specialized, which means new doors are opening for people with less-traditional but highly valuable backgrounds.

- Technical Experts and PhDs: Deep-tech funds working in AI, biotech, or quantum computing are actively hunting for people with advanced technical degrees. If you have a Ph.D. in a cutting-edge field, your ability to vet complex technology is a rare and powerful skill.

- MBA Programs: A top-tier MBA can be a fantastic pivot point, especially if you're switching careers. These programs offer a structured on-ramp through internships, venture competitions, and access to a powerful, ready-made network.

- Journalists and Community Builders: Some firms are hiring people with a talent for storytelling and network-building to run their "platform" or community efforts. If you know how to create compelling content and bring people together, you can be critical to supporting a fund's portfolio and building its brand.

At the end of the day, getting into venture capital is about identifying your "spike"—that deep, defensible expertise that makes you uniquely qualified to spot and support the next generation of founders. It's about crafting a story that proves you can add value from day one.

Building a Profile That VCs Can't Ignore

In a field as competitive as venture capital, your resume is just the price of admission. The real game is building "signal"—tangible, public proof that you already think and act like an investor. VCs aren't just looking for someone who wants a job; they're hunting for people who are already obsessed with the startup world.

This means you need to build a profile that screams value before you ever set foot in an interview. It's all about showing, not telling. You have to prove you have a unique perspective and an uncanny ability to spot opportunities everyone else is missing. Your goal is to make hiring you feel like an obvious, low-risk bet.

Develop a Defensible Spike of Expertise

Generalists don't get hired in VC. Full stop. Saying you're "passionate about tech" is the fastest way to get your resume archived. What you need is a "spike"—a deep, almost nerdy expertise in a specific sector or technology. This is what turns you from just another qualified person into an indispensable asset.

Pick a domain you're genuinely curious about. It could be anything from developer tools and climate tech to the future of consumer healthcare. This focus lets you move past the surface-level chatter and develop a nuanced, defensible point of view.

The real value of a spike isn't just knowing a sector; it's being able to recognize non-obvious patterns and identify breakout companies before they hit the mainstream. This is the core skill of a great investor.

That specialized knowledge becomes your calling card. It makes you the go-to person a fund needs for sharp insights on a particular market.

Build an Investment Track Record (Without a Fund)

You don't need a multi-million dollar fund to prove you have an eye for great companies. Demonstrating your investment instincts is about process and conviction, not just capital. You can start building a credible track record long before you ever join a firm.

A powerful way to do this is by creating a "shadow portfolio." Here’s how it works:

- Identify Companies: Pick 5-10 private, early-stage startups you’d hypothetically back. Make sure they fit a coherent investment thesis.

- Write Investment Memos: For each one, draft a detailed memo explaining why you'd invest. Cover the team, product, market size, and your conviction. You can sharpen the analytical skills needed for this by learning how to build financial models.

- Track Performance: Now, you watch. Did they raise their next round? Ship a killer product? Pivot? Documenting their journey either validates or refutes your original thesis.

Another fantastic way to get in the game is by joining an angel syndicate on a platform like AngelList. It might require a small capital commitment, but it gives you direct access to deal flow, founder pitches, and the diligence process of seasoned investors.

Use Content to Showcase Your Thesis

Your brilliant ideas are worthless if they stay in your head. Creating content is the single most effective way to scale your reputation and broadcast your investment thesis. It's your chance to think out loud and show VCs exactly how you analyze markets.

Start sharing your insights where the VC community already hangs out:

- A Niche Newsletter or Blog: Use something like Substack or Medium to publish deep dives on your chosen sector. Analyze market shifts, profile under-the-radar startups, or break down a company’s GTM strategy. Consistency matters more than frequency.

- Insightful Social Media Posts: Twitter (X) and LinkedIn are your best friends here. A single, well-crafted thread analyzing a recent funding round can generate more inbound interest than a hundred cold emails ever could.

This public work becomes a portfolio of your thinking. When a VC partner looks you up, they won’t just see a resume; they'll find a body of work that proves you're a serious, engaged thinker. It’s the ultimate way to show your work.

Network with Founders First

Here's a common mistake: most candidates focus all their networking on investors. The most valuable relationships you can build, however, are with early-stage founders. They are the heart of the entire ecosystem and the source of all future deals.

Instead of asking for coffee, offer to help. If you're a marketing whiz, offer to review a founder's go-to-market deck. If you're a product guru, give feedback on their UX. Adding real value with zero expectation of anything in return builds authentic relationships and serious trust.

These connections pay off in spades. Founders talk—to each other and to their investors. Becoming known as a helpful, smart resource in the founder community is a powerful backchannel into the VC world. A warm recommendation from a founder a VC respects is worth more than any perfectly polished cover letter.

Mastering Strategic Networking and Outreach

Let's get one thing straight: your network isn't just a list of names on LinkedIn. In venture capital, it’s the primary channel for opportunity. Most roles in this insular, relationship-driven world are filled through quiet referrals and backchannel introductions, not public job postings.

To break in, you need to go far beyond generic advice. The goal isn't just to ask for a job; it's to build genuine, long-term relationships by adding value before you ever ask for anything. Stop thinking about mass emailing partners and start acting like a valuable node in the ecosystem, connecting interesting people and ideas.

Mapping Your Outreach Targets

Your first move is figuring out who to talk to at your target funds. Sending the same email to every partner is a surefire way to get ignored. You have to be strategic.

- Associates and Principals: These folks are your best bet. They’re closer to the day-to-day hiring process and were in your shoes not too long ago. They’re generally more willing to share their story and offer practical advice.

- Platform and Operations Roles: People in these positions are professional network-builders. Connecting with them can give you a real sense of a fund’s culture and what they’re looking for.

- Emerging Fund Managers: The founders of newer, smaller funds are often more accessible and actively looking to build their own networks. A relationship here can be an incredible learning experience.

This focused approach shows you’ve done your homework and respect their time, which immediately sets you apart from the crowd.

The Art of the Warm Introduction

A warm intro is the absolute gold standard for getting a meeting. It’s a trusted signal from someone in their network that you're worth their time. But getting one isn't magic; it requires a thoughtful process.

First, use LinkedIn to find a mutual connection. Then, when you ask for the introduction, make it ridiculously easy for them. Draft a short, forwardable blurb that explains who you are, why you want to speak with the person, and what you're hoping to learn.

Pro Tip: Never make your mutual connection do the heavy lifting. A simple, copy-and-paste paragraph that outlines your background and your specific "ask" (e.g., "15 minutes to hear about their path into VC") dramatically increases the odds they’ll make the intro for you.

This simple bit of prep shows you’re a professional who respects everyone’s time.

Crafting Cold Emails That Actually Work

When a warm intro isn't an option, a well-crafted cold email can still get the job done. The trick is to be specific, concise, and value-first. Your goal isn't to get an interview from the first email—it's just to start a conversation.

One of the most effective cold outreach tactics is sharing relevant deal flow. Find an interesting, under-the-radar startup that genuinely fits the firm's thesis and send it their way. This flips the dynamic instantly: you're not asking for something, you're offering something of value.

As you build these connections, it's also crucial to build a personal brand on LinkedIn that opens doors. This public signal makes your cold outreach feel much warmer.

Don’t underestimate how much networks matter. Over 70% of U.S. startup funding flows through just six mega-funds. Data also shows that 60-70% of VC hires come from bulge-bracket banks or top consulting firms, where powerful alumni networks act as gatekeepers.

To keep your efforts organized, it helps to think of your outreach like a sales funnel. Tracking your progress is key to understanding what's working and where you need to adjust your strategy.

VC Outreach Funnel Stages and Metrics

A framework to track your networking efforts, helping you visualize your progress from initial contact to securing an interview.

| Funnel Stage | Key Action | Success Metric to Track |

|---|---|---|

| Top of Funnel | Identify and list target individuals at desired funds. | Number of quality contacts added to your list per week. |

| Outreach | Send personalized cold emails or request warm intros. | Email open rate; Response rate (aim for 10-15%). |

| Initial Call | Conduct a 15-20 minute informational interview. | Number of calls scheduled per week. |

| Follow-Up | Send a thank-you note and share relevant articles or deals. | Number of meaningful follow-ups sent. |

| Relationship | Nurture the connection over weeks/months. | Number of contacts moved to "active relationship" status. |

| Interview | Convert a relationship into a formal interview process. | Number of first-round interviews secured. |

This simple tracking system provides a clear picture of your pipeline, holding you accountable and showing you where you’re gaining traction. It turns a daunting process into a manageable, step-by-step campaign.

Getting Through the Venture Capital Interview Gauntlet

After months of hustling—networking, building your thesis, and getting your name out there—landing a VC interview feels like a huge win. And it is. But now the real work begins.

A VC interview isn't about walking through your resume. It’s a series of pressure tests designed to see how you think, how you defend an opinion, and whether you have the gut instinct to make high-stakes bets on unproven ideas. Firms are looking for a rare mix of analytical horsepower, market intuition, and personality.

The Anatomy of a VC Interview Process

There's no single, standardized interview loop in venture, but most firms run a similar playbook. You can expect a multi-stage process that gets progressively deeper and more demanding, moving from broad market conversations to intense, deal-specific analysis.

Think of it as a funnel. Each stage is designed to vet a different part of your investor DNA—from your raw market knowledge to your analytical rigor, and finally, whether the partners can see themselves working with you for the next 10 years.

Here’s a common sequence of what you'll face:

- The Market & Thesis Chat: This is the entry point. You’ll talk about trends, recent funding rounds, and what sectors you’re excited about. They want to see that you’re genuinely plugged in.

- The Live Company Pitch: This is a classic. You’ll be asked to pitch a real startup you’d invest in today. It’s a direct test of your sourcing instincts and how you build an investment case.

- The Case Study / Investment Memo: This is where the rubber meets the road. You’ll get a packet on a company and be tasked with writing a full investment memo, often on a tight deadline.

- Partner & Fit Interviews: The final round focuses on you. Why do you want this job? Do you fit the firm’s culture? This is all about your story, your drive, and your personality.

Knowing this flow helps you prepare for what’s coming instead of being caught off guard.

Your Go-To Investment Pitch

The "pitch me a company" question is probably the single most important moment in the entire process. It’s not just a question; it’s a window into how your mind works. Your answer reveals everything about your sourcing ability, your thesis, and how you analyze opportunities.

First rule: don't pitch a unicorn everyone knows, like Stripe or a famous YC graduate. The goal is to demonstrate differentiated thinking. Pick an under-the-radar company that aligns with your investment thesis. This shows you have a unique point of view and can find gems others have missed.

Brace yourself for a cross-examination. Interviewers will actively poke holes in your pitch, questioning everything from the market size to the team’s background. Your job isn't to be defensive, but to calmly and logically defend your conviction. That’s what they’re really testing.

Structure your pitch like a mini-memo. Kick it off with a sharp one-liner, then walk them through the problem, solution, market, team, and why you believe this specific company has the potential for outsized, venture-scale returns.

Tackling the Investment Memo Case Study

The case study is where you prove you have the analytical chops. A firm might give you a few hours or a whole weekend to go deep on a target company and write a memo with a clear "invest" or "pass" recommendation.

This isn’t just a financial modeling test. While you’ll definitely need to dig into the unit economics and potential exit scenarios, the qualitative story you build is just as crucial.

A strong memo is structured, persuasive, and covers these key pillars:

- Executive Summary: Lead with your recommendation—a clear "yes" or "no"—and the top three reasons why.

- Team: What’s the verdict on the founders? Do they have the right background, grit, and industry expertise to pull this off?

- Market Opportunity: Size it up. Build a case for the TAM, SAM, and SOM using both top-down and bottom-up analyses. What are the tailwinds?

- Product & Tech: What makes the product special? Is there a real moat or proprietary technology that sets it apart?

- Risks & Mitigants: Show you're not just a cheerleader. What could kill this company? Acknowledge the risks and propose how they might be managed.

This exercise simulates the day-to-day job of an investor. Your ability to quickly synthesize messy information and build a coherent argument is everything. For more practice, review our deep dive into common venture capital interview questions and how to frame your answers.

Nailing the “Fit” Interview

Finally, don’t blow off the fit interview. VC firms are tiny partnerships. A single personality mismatch can throw off the whole dynamic. The partners aren’t just hiring an analyst for a couple of years; they’re potentially bringing on someone they’ll be working with for a decade or more.

Get your story straight for "Why VC?" and, more importantly, "Why this firm?" Vague answers won’t cut it. Your narrative needs to be authentic and specific. Draw a direct line from your experience—as a founder, operator, banker, whatever—to the skills needed to be a great investor.

Show you’ve done your homework. Mention a portfolio company you admire or a blog post a partner wrote that resonated with you. It proves you’re not just spamming every firm out there. You’re targeting them for a reason. In the end, it’s often the candidates with genuine curiosity, intellectual honesty, and a low ego who get the offer.

Got Questions About Breaking Into Venture? We've Got Answers.

The road to venture capital is notoriously opaque, and it's easy to get bogged down by the same nagging questions that trip up most aspiring VCs. What skills really matter? What's the one mistake that sinks otherwise great candidates?

Let's cut through the noise. Here are straight answers to the most common questions I hear, based on years of seeing people succeed—and fail—at breaking in.

Is an MBA a Golden Ticket into VC?

Short answer: no. But it can be a very useful one, depending on where you're coming from.

An MBA from a top-tier program can absolutely be a powerful launchpad, especially if you're making a significant career pivot. These programs are structured for it, offering things like venture fellowships, direct recruiting pipelines, and, of course, an instant, high-powered network of alumni VCs.

But let's be real: the industry is shifting. More and more, firms prize deep, hands-on experience over a general business degree. If you've spent the last few years scaling a startup from 10 to 100 people or you're a leading researcher in a hot field like generative AI, that experience is your golden ticket. It's often far more valuable than anything learned in a classroom.

The real calculus here is opportunity cost. Ask yourself: will the network and credential from an MBA give you more of an edge than two years spent building a company, honing a deep technical skill, or embedding yourself in your target industry? For a growing number of people, the answer is a clear "no."

So, an MBA can definitely open doors. But having a "spike" in a relevant, in-demand field can often just kick them down.

Do I Need to Be a Financial Modeling Guru?

This is a classic "it depends" scenario, and it hinges entirely on the fund's stage.

For later-stage and growth equity funds, you bet. These firms are scrutinizing mature businesses with real financials. You absolutely need to be able to build complex discounted cash flow (DCF), LBO, and operating models in your sleep. It's table stakes.

But for the early-stage world (think Pre-Seed to Series A), the game is completely different. Here, heavy-duty modeling is almost irrelevant because you're dealing with too many unknowns. No one is building a three-statement model for a two-person team with a great idea.

What matters at this stage is your grasp of the fundamentals: cap tables, unit economics (LTV/CAC), and a solid approach to market sizing. The real skill is assessing the founders, the market pull, and the product vision.

What's the Single Biggest Mistake People Make?

Easy. Being a generalist.

The fastest way to get your resume tossed is to say you're "passionate about technology." It's a huge red flag. It tells the partner you haven't done the work to develop a point of view. VCs don't hire tourists; they hire specialists who can bring a unique, defensible perspective.

You have to develop a "spike"—a deep, almost obsessive expertise in a specific niche. Maybe it's vertical SaaS for the construction industry, API-first developer tools, or platforms for clinical trial management.

Having a well-researched thesis on a sub-sector you know inside and out is infinitely more powerful than a surface-level understanding of every trend on TechCrunch. It proves you can add real value—and maybe even bring in proprietary deals—from day one.

How Can I Get Investment Experience If I'm Not an Angel Investor?

You don’t need a fat bank account to build an investment track record. You just need to show you can think like an investor and are willing to do the work.

Here are two fantastic ways to do it without writing a check:

- Build a "shadow portfolio." Pick 5-10 private companies you'd invest in if you had the capital. Write a detailed investment memo for each one, laying out your thesis. Then, track them publicly. This becomes a living document of your investment judgment.

- Go help some founders. Find early-stage startups you believe in and offer to help them for free. Use your skills—whether in go-to-market strategy, product feedback, or market research—to add value. This gets you in the trenches and proves you can spot and support talent.

Taking these steps shows incredible initiative. It gives you a bank of real-world examples to talk about in interviews and proves you're already in the game.

Ready to ace your VC interview? Soreno provides an AI-powered platform to practice case studies, investment memos, and behavioral questions in a realistic mock interview setting. Get instant, rubric-based feedback on your structure, communication, and business insights to walk into your interviews fully prepared. Start your free trial today at soreno.ai.