A Founder's Guide to the Venture Capital Term Sheet

Decode the venture capital term sheet. This guide breaks down key clauses, valuation, and negotiation strategies to help you secure the best deal.

So you've got an investor interested in your startup? Congratulations. The first major document you'll likely see from them is the venture capital term sheet.

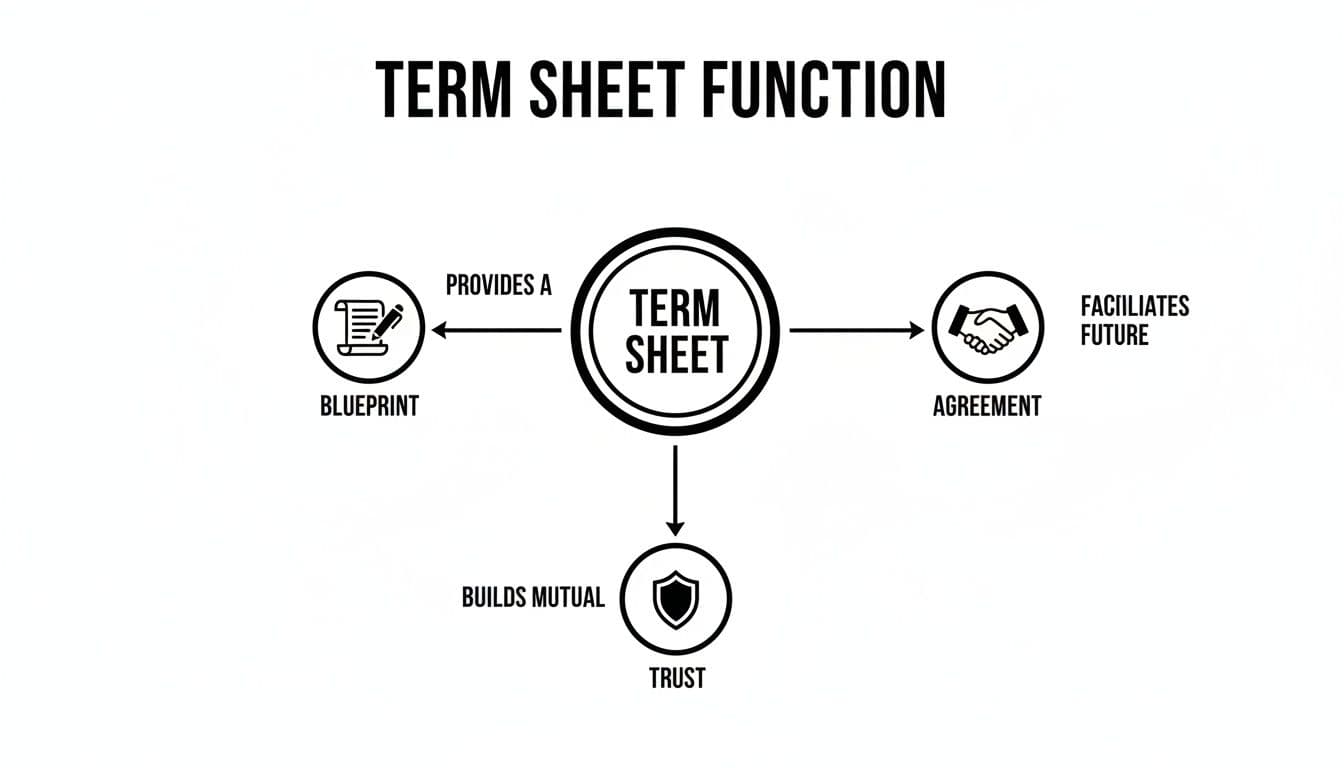

This isn't the final, legally-binding contract. Think of it more like a blueprint for a partnership. Before you start pouring the concrete and framing the walls of your company together, you both need to agree on the fundamental design. A term sheet lays out all the critical terms of the proposed investment, making sure everyone is on the same page before calling in the expensive lawyers.

What Is a Venture Capital Term Sheet Anyway?

At its core, a term sheet is a declaration of intent. It’s a document that translates all those high-level conversations about your startup's potential into the specific economic and control provisions of an investment deal.

This is where the rubber meets the road. It allows you and your potential VC partner to hash out the most important points—like valuation, ownership percentage, and decision-making power—before anyone commits serious time or money to the formal legal process.

The Blueprint for Your Partnership

The main job of a term sheet is to create a crystal-clear, shared understanding between you and your investors. It’s where you outline the core mechanics of the deal. The key elements typically include:

- Valuation: What the investor believes your company is worth before their money comes in.

- Investment Amount: The total capital the VC firm plans to inject into your business.

- Board Composition: Who gets a seat at the table to help steer the ship.

- Key Clauses: The specific rights and protections for everyone involved.

This negotiation is a critical first test of the founder-investor relationship. How you work through these points sets the tone for the years of collaboration to come.

Legally Binding or a Handshake Deal?

Here's a crucial point: most of a term sheet is non-binding. It’s a gentleman's agreement, a moral commitment. Backing out of a signed term sheet without a very compelling reason can seriously damage a founder's (or an investor's) reputation in the startup world.

A term sheet is more than just paper; it’s a reflection of the trust and shared vision between a founder and their financial partner. It establishes the ground rules for how you will build the company together.

That said, a couple of clauses are almost always legally enforceable:

- Confidentiality: This clause ensures that neither you nor the investor can share the details of the proposed deal with anyone else.

- Exclusivity (or "No-Shop"): This gives the investor a set period of time, usually 30-60 days, where you agree not to solicit or accept investment offers from other firms.

Ultimately, the term sheet is the foundational document that kicks off a successful funding round. But remember, VC funding is just one path. It's smart for founders to understand the entire landscape of financial options. To get a wider view, check out these 10 essential sources of funding for startups, which cover everything from grants to different types of equity. This broader knowledge will help you decide if and when a VC partnership is truly the right move for you.

Decoding the Economic Terms That Drive Your Deal

While control terms are about how the company is run, the economic terms are all about the money. They dictate who gets paid what when there's an exit, like a sale or an IPO. This is the financial core of the venture capital term sheet, and it directly shapes the potential payday for you, your team, and your investors. Getting these terms right is the key to fueling your growth without giving away the farm.

Think of the term sheet as more than just a legal document. It's the blueprint for your partnership with the investor, a handshake agreement on the core deal points, and the very foundation of trust you'll build on.

As you can see, it's about aligning everyone's expectations from day one to build a relationship that can go the distance.

Pre-Money vs. Post-Money Valuation

Valuation is the headline number that grabs all the attention, but it's not as simple as one figure. You have to understand the two sides of the coin.

- Pre-Money Valuation: This is the agreed-upon value of your company right before the new cash comes in. It’s what your business is worth as is, today.

- Post-Money Valuation: This is simply the pre-money value plus the new investment. It’s what your company is worth the second after the deal closes.

So, the formula is straightforward: Post-Money Valuation = Pre-Money Valuation + Investment Amount.

This distinction is absolutely critical because it sets the investor's ownership stake. Their percentage is calculated as their investment divided by the post-money valuation. Getting this right is a major focus, and increasingly, investors are using new methods like the rise of alternative data in private equity sourcing to get an edge in their valuation and deal structuring.

The Employee Option Pool Shuffle

Here’s a classic move you need to watch for. Before an investor agrees to that shiny pre-money valuation, they will almost always insist you create or top up an employee stock option pool (ESOP). This is a block of equity set aside for hiring and retaining future talent—a perfectly reasonable request.

But here’s the trick: investors demand this pool be created from the pre-money valuation. This means the dilution from setting aside those options hits only the existing shareholders—you and your co-founders. The new investors are shielded. This is so common it has a name: the "option pool shuffle," and it effectively lowers the real pre-money valuation for the founders.

Liquidation Preference: The Payout Order

If valuation is the most talked-about term, liquidation preference might be the most important. It dictates who gets paid first—and how much they get—when the company is sold or liquidated.

Think of it as the investor’s safety net. They get their money back before common stockholders (that's you and your employees) see a single dollar. The most common structure you'll see is a 1x non-participating preferred stock.

1x Non-Participating Preference: In an exit, investors have a choice. They can either (A) take 1x their original investment back, or (B) convert their preferred shares into common stock and get their pro-rata slice of the pie alongside everyone else. Naturally, they'll pick whichever option makes them more money.

This is widely considered the standard, founder-friendly term. Watch out for more aggressive, investor-friendly versions like "participating preferred," which lets an investor get their money back and then take their ownership share of whatever is left. To really get a handle on these payout scenarios, you need to know your numbers inside and out, which is why we have a guide on how to analyze financial statements.

Anti-Dilution Provisions: Protecting Against Down Rounds

What happens if your next funding round is at a lower valuation than this one? That’s called a "down round," and it's a scenario every investor wants protection from. This protection comes in the form of anti-dilution provisions.

These clauses automatically adjust the conversion price of the investor's preferred stock, effectively giving them more shares to make up for the drop in value. There are two main flavors:

- Full Ratchet: This is the nuclear option—brutal for founders and extremely rare today. It reprices all of the investor's previous shares to the new, lower price of the down round.

- Weighted-Average: This is the market standard and much more balanced. It uses a formula that considers both the price and the size of the down round to calculate a new, blended conversion price.

To give you a better sense of how these economic terms play out in negotiations, here's a quick comparison.

Economic Terms At a Glance

| Term | Purpose | Founder-Friendly Example | Investor-Friendly Example |

|---|---|---|---|

| Valuation | Determines the price per share and ownership percentages. | A higher pre-money valuation, reflecting strong traction and future potential. | A lower pre-money valuation to secure a larger equity stake for the same investment. |

| Liquidation Preference | Protects investor capital in an exit; defines the payout order. | 1x Non-Participating Preferred. Investors get their money back OR their pro-rata share. | 2-3x Participating Preferred. Investors get a multiple of their money back AND their pro-rata share. |

| Option Pool | Sets aside equity to attract and retain key future employees. | Pool sized for 12-18 months of hiring needs; created from the post-money valuation. | A large pool (15-20%); created from the pre-money valuation (the "shuffle"). |

| Anti-Dilution | Protects investors from dilution in a future "down round." | Broad-Based Weighted-Average. A formula that is less punitive to founders. | Full Ratchet. Reprices all prior shares to the new, lower price. Extremely harsh. |

This table isn't exhaustive, but it hits the big-ticket items that drive the financial outcome of your deal. Ultimately, the goal is to find a fair middle ground that gets the deal done and keeps everyone motivated for the long journey ahead.

Understanding the Control Terms That Shape Your Company

While economic terms dictate how the pie is divided, control terms define who gets to decide how the pie is baked. A venture capital term sheet is as much about governance and power as it is about cash. These are the clauses that shape your company's future by establishing who calls the shots on the big strategic moves.

Neglecting these provisions is a classic founder mistake. It's surprisingly easy to win on valuation but lose the ability to steer your own ship. To maintain the right balance of authority as you scale, you have to get these terms right.

The Board of Directors Composition

The most visible control term is the makeup of your Board of Directors. This is the group with the ultimate authority to hire and fire senior management (including you), approve budgets, and set the company's overall strategy. A term sheet will lay out exactly how the board will be structured.

For an early-stage company, a common board structure might look something like this:

- Two Founder Seats: This ensures the founding team's vision and operational know-how are represented.

- One Investor Seat: This seat is typically held by the lead investor from the current financing round.

- One Independent Seat: This is a neutral third party, often a seasoned executive or industry expert, who is mutually agreed upon by both the founders and the investors.

This 2-1-1 structure for a four-person board is popular for a good reason—it prevents any single party from having a majority. It forces everyone to collaborate and build consensus, which is the foundation of a healthy board dynamic.

Protective Provisions: The Investor Veto

Perhaps the most powerful control mechanism for investors is the set of protective provisions. Think of these as a specific list of corporate actions that cannot happen without the explicit approval of the preferred stockholders—in other words, your investors.

These provisions are essentially an investor veto right. They aren't meant for meddling in day-to-day operations, but rather for safeguarding their capital against major decisions that could fundamentally alter their investment or wipe out its value.

Here are some of the most common actions covered by protective provisions:

- Selling the company: Prevents a fire sale at a price the investor thinks is too low.

- Changing board size or composition: Ensures their board seat can't be diluted away.

- Issuing senior stock: Blocks the creation of a new class of stock with rights superior to their own.

- Taking on significant debt: Protects the company from becoming over-leveraged.

- Amending the company charter: Prevents changes to the core governance documents without their consent.

It’s a classic balancing act. Founders need the flexibility to run the business, while investors need to know their capital is protected from catastrophic decisions. The key is to negotiate a set of provisions that is standard for your stage and not overly restrictive.

If you see an unusually long list of protective provisions, pushing back is a reasonable negotiation point. Your goal is to keep as much operational freedom as you can while still giving your investors the security they need to write the check.

Pro-Rata and Information Rights

Beyond the boardroom, two other rights have a big impact on control and future fundraising: pro-rata rights and information rights. You'll find these in almost every VC term sheet.

Pro-Rata Rights give your current investors the right, but not the obligation, to participate in future funding rounds to maintain their ownership percentage. So, if an investor owns 15% of your company today, this right allows them to buy 15% of the next round, preventing their stake from getting diluted by new investors.

This is generally a good sign—it shows your investors believe in the company and are in it for the long haul. Just be wary of "super pro-rata" rights, an aggressive term where investors demand the right to buy more than their current stake, which can crowd out new capital you might want to bring in.

Information Rights simply detail the financial and operational reporting you'll need to provide. This typically includes:

- Monthly or quarterly financial statements (income statement, balance sheet, cash flow).

- An annual, audited financial report.

- An annual budget and operating plan for the upcoming year.

These rights keep your investors in the loop on the company's performance and health. They are completely standard and demonstrate transparency, which is crucial for building a trusting, long-term partnership with your financial backers. Agreeing to these is a fundamental part of taking on venture capital.

Navigating Red Flags and Negotiation Priorities

Alright, you've dissected the key clauses of a term sheet. Now comes the real test: turning that knowledge into a smart negotiation strategy. This is where the rubber meets the road, moving from textbook definitions to protecting your company's future. It's all about spotting the landmines before you step on them and knowing which hills are worth dying on.

Let's be clear: the market has a huge say in what terms are considered "standard." With recent headwinds in venture capital, investors are more selective and focused on protecting their downside. This climate shapes every term sheet you'll see, making it even more vital to know what to look for and what to push back on. Diving into these private market trends will give you critical context.

Common Red Flags to Watch For

A term sheet is more than just a deal; it’s a window into how your potential investors think about risk and partnership. While most VCs start with standard, founder-friendly documents, some will slip in aggressive terms. Your job is to catch them and, more importantly, understand why they're there.

Here are three major red flags that should make you pause:

-

Participating Preferred Stock: This is the dreaded "double-dip." It means investors get their original investment back first, and then they take their ownership percentage of whatever is left. In anything but a massive home-run exit, this can gut the payout for you and your team. The market standard, and what you should push for, is 1x non-participating preferred stock.

-

Full-Ratchet Anti-Dilution: As we covered, this is the most brutal form of anti-dilution. If you have to raise a down round later, it reprices all of the investor's shares to that new, lower price. The result is catastrophic dilution for everyone else. The fair, and common, alternative is a broad-based weighted-average formula.

-

Excessive Control Terms: Be on the lookout for a laundry list of protective provisions that give VCs veto power over day-to-day business decisions. Another one to watch is super pro-rata rights, which let an investor increase their ownership stake in future rounds. This can block you from bringing in new, strategic investors you might need later.

Establishing Your Negotiation Priorities

Here's a secret: you won't win every point. A great negotiation isn't about winning; it's about getting a fair deal that keeps everyone motivated for the marathon ahead. Founders often fixate on the pre-money valuation, but a handful of other terms can have a far bigger impact on your take-home pay and your ability to run the company.

Negotiation isn't about winning; it's about achieving a fair outcome that keeps all parties aligned and motivated for the long journey ahead. A good deal is one where everyone feels they got what they needed.

Think of it like a pyramid. Some terms are the foundation of a healthy deal, while others are just nice-to-haves.

Here’s a practical hierarchy to guide you:

-

Clean Economic Terms: This is your top priority. Fight for a 1x non-participating liquidation preference and broad-based weighted-average anti-dilution. These two clauses ensure proceeds are split fairly in an exit and protect you from getting wiped out in a future down round. They are non-negotiable.

-

Founder Vesting and Control: Make sure your own vesting schedule is standard—a four-year schedule with a one-year cliff is typical. Just as important is a balanced board structure where no single investor or faction has total control. These terms are fundamental to your ability to lead.

-

The Option Pool Shuffle: This is a classic shell game. Pay very close attention to how the employee option pool is calculated. Argue for a realistic pool size that covers hiring for the next 12-18 months, and try to get it created from the post-money valuation to reduce your personal dilution.

-

Valuation: Yes, valuation matters, but it’s often the most flexible term. A slightly lower valuation with clean, founder-friendly terms is almost always a better deal than a sky-high valuation loaded with traps. Once the term sheet is signed, you still have the entire venture capital due diligence process to get through, so starting with a foundation of trust is key.

How to Master the Term Sheet for Your Interview

Knowing the nuts and bolts of a venture capital term sheet is one thing. Being able to explain it clearly under the pressure of a high-stakes interview? That's a whole different ballgame. This is where you have to bridge the gap between technical details and sound commercial judgment.

The goal isn't just to rattle off definitions. Your interviewer wants to see that you can think like an investor, balancing risk and reward while navigating the delicate founder-VC partnership. Questions about the term sheet are designed to test your ability to dissect a deal's structure, understand the incentives each clause creates, and make a smart call when priorities conflict. Let's walk through how to handle these common interview questions.

Question 1: Walk Me Through a Standard Series A Term Sheet

This is a classic opener, and it’s designed to see if you have a solid grasp of the fundamentals. The key is to avoid just listing clauses one by one. You need to tell a story, grouping the terms by what they actually do: dictating the economics and establishing control.

A great answer always starts with the big picture. Frame the term sheet for what it is: a non-binding blueprint that gets founders and investors on the same page before everyone spends a fortune on legal fees drafting the final documents.

From there, break it down logically:

-

The Economics (Who gets what money and when): Kick things off with the headline number: valuation. You should quickly explain the difference between pre-money and post-money. Then, immediately pivot to the most important economic term of all—the liquidation preference. Mention that a 1x non-participating preferred is the clean, market-standard deal. After that, touch on the option pool, explaining how creating it pre-money affects founder dilution. Wrap up the economics with anti-dilution rights, noting that a broad-based weighted-average formula is what you typically see.

-

Control (Who gets to make the big decisions): Start with the Board of Directors. Explain how a typical Series A board is set up to avoid any single party having total control—a common split is two founders, one investor, and one independent director. Next, cover protective provisions, which are basically investor veto rights over major company decisions, like selling the business. Finally, mention pro-rata rights, which give investors the option to maintain their ownership percentage in future funding rounds.

Structuring your answer this way proves you don't just know what the terms are; you understand how they all work together to shape the entire deal. For more practice, it's a good idea to check out our broader guide on venture capital interview questions to cover all your bases.

Question 2: Comparing Two Competing Term Sheets

This is where the rubber meets the road. This kind of scenario-based question isn't about finding a single "right" answer. It’s a test of your strategic thinking and your ability to articulate your reasoning.

The Prompt: "You have two term sheets on the table. Term Sheet A offers a $20M post-money valuation with a 1x participating preferred liquidation preference. Term Sheet B offers a $15M post-money valuation but with a standard 1x non-participating preferred preference. Which one do you take, and why?"

This is a scenario you will absolutely encounter, so it's critical to have a structured way to think through it. Here’s a framework for a strong answer.

To start, you need to lay out the core conflict. A great answer begins by showing you understand the trade-off at play.

"This is a classic dilemma that pits a higher headline valuation against cleaner, more founder-friendly terms. While that $20M valuation in Term Sheet A looks great on paper, the participating preferred clause is a major red flag. It creates a real misalignment of incentives down the road."

Next, you have to run the numbers—at least conceptually. Explain that in most realistic exit scenarios (anything short of a spectacular home run), the participating preferred in Term Sheet A could actually leave founders and employees with less cash. This "double-dip" feature lets the investor get their money back plus their ownership share of whatever is left, which heavily distorts the economics.

Finally, state your decision and justify it. Term Sheet B, even with the lower valuation, is almost always the better long-term choice. It sets a healthy precedent for future rounds and aligns everyone to work toward the same goal: making the common stock as valuable as possible. Choosing it shows you prioritize building a sustainable, fairly structured company over chasing a vanity metric.

To help structure your answers for any term sheet question, you can use the following framework.

Interview Question Model Answer Framework

| Component | Key Points to Address | Example Language |

|---|---|---|

| Acknowledge the Trade-Off | Start by identifying the core tension or conflict in the question. Show you see both sides. | "This scenario highlights the classic tension between a higher valuation and founder-friendly terms..." |

| Define the Key Clause | Briefly and clearly explain the specific term at the heart of the question (e.g., participating preferred). | "Participating preferred, often called the 'double-dip,' allows an investor to receive their initial investment back and then share in the remaining proceeds..." |

| Model the Impact | Walk through how the clause affects outcomes for founders, employees, and investors in different exit scenarios. | "In a modest exit, say $50M, the participating feature would disproportionately reward the investor, while in the non-participating deal..." |

| Discuss Incentives | Explain how the term aligns or misaligns the long-term interests of the parties involved. | "This misaligns incentives because the investor gets a good return even in a mediocre outcome, reducing the shared drive for a massive success." |

| State Your Conclusion | Make a clear choice and provide a strong, business-focused justification for your decision. | "For that reason, I’d choose Term Sheet B. It sets a healthier precedent and ensures everyone is rowing in the same direction for the long haul." |

By following this structure, you're not just answering the question; you're demonstrating a sophisticated understanding of how deal terms shape a company's future. You're showing that you think like a true partner, not just a spreadsheet.

Wrapping Up: Your Top Questions Answered

Even after you've gotten a handle on the key economic and control terms, some practical questions always seem to pop up. This is perfectly normal. The process can feel a bit mysterious the first few times you go through it.

Let's clear up some of the most common points of confusion to make sure you know exactly what to expect after that term sheet lands in your inbox.

Is a Term Sheet Actually Legally Binding?

For the most part, no. Think of a term sheet as a roadmap or a "gentleman's agreement." It outlines the major points of the deal and creates a strong moral commitment, but the big-ticket items—like valuation and investment amount—aren't legally enforceable on their own.

That said, a couple of clauses are almost always binding, and you absolutely need to treat them as such:

- Exclusivity (or "No-Shop"): This is a big one. It legally stops you from shopping the deal around or talking to other investors for a set period, usually 30 to 60 days.

- Confidentiality: Simple enough. Both sides agree to keep the deal terms and any sensitive information shared during the process under wraps.

If you breach these two clauses, you could face real legal trouble. While backing out of the non-binding parts won't get you sued, it will torch your reputation. The startup world is small, and word gets around fast.

So, What Happens Right After We Sign?

Signing the term sheet isn't the finish line; it’s the starting pistol for the real race. Once the ink is dry, two things kick off immediately and run in parallel: due diligence and drafting the definitive documents.

First, the investor’s team will start a deep dive into your company. This is due diligence. They’ll comb through your financials, customer contracts, tech stack, and corporate records to make sure everything you've told them checks out.

At the same time, lawyers on both sides get to work turning the term sheet's bullet points into dense legal contracts. These are the "definitive docs," which typically include a Stock Purchase Agreement, an updated Certificate of Incorporation, and an Investors' Rights Agreement. The money doesn't hit your bank account until diligence is complete and everyone has signed these final agreements.

How Long Does It Take to Get From a Signed Term Sheet to Cash in the Bank?

This can really vary, but a good rule of thumb is anywhere from 30 to 90 days. What makes the difference? It comes down to how complex the deal is, how quickly everyone's lawyers move, and just how deep the diligence process goes.

Pro Tip: You can seriously speed this up by having your house in order. A startup that walks in with a clean, well-organized data room full of all its legal, financial, and operational documents is an investor's dream. It signals professionalism and makes their job easier.

The "no-shop" period is usually set to match this expected timeline, giving the investor enough runway to complete their work without worrying about you fielding other offers.

How Much Do Market Conditions Really Matter?

A ton. Term sheets don't exist in a bubble—they're a direct reflection of the broader economy and what investors are thinking.

When the market is "hot" and capital is flowing freely, terms swing in the founder's favor. You'll see higher valuations, cleaner terms, and more competition among VCs. But when the market tightens up, the power shifts. Investors will push for more protection and investor-friendly terms to de-risk their investment.

For instance, we've seen massive amounts of venture capital recently pour into sectors like AI and fintech. If you're in one of those hot industries, you can expect more competitive term sheets and better valuations than a founder in a less-hyped space. You can dig into the data on these trends yourself by reading the full research about VC investment patterns.

Knowing which way the wind is blowing gives you critical context for your negotiation. It helps you understand what's a standard market term versus what's an investor trying to take advantage of a down market.

Mastering the venture capital term sheet is a critical skill for any finance or consulting interview. With Soreno, you can practice walking through complex deal scenarios with an AI interviewer trained on real MBB case materials. Get instant, rubric-based feedback on your structure, business insight, and communication to make sure you’re ready for the toughest questions. Start your 7-day free trial and ace your interview. Visit us at https://soreno.ai.